AI Continues Ruling Q1 NYC Seed Trends

On average, companies we categorized as AI raised 23% more than the rest of the data set.

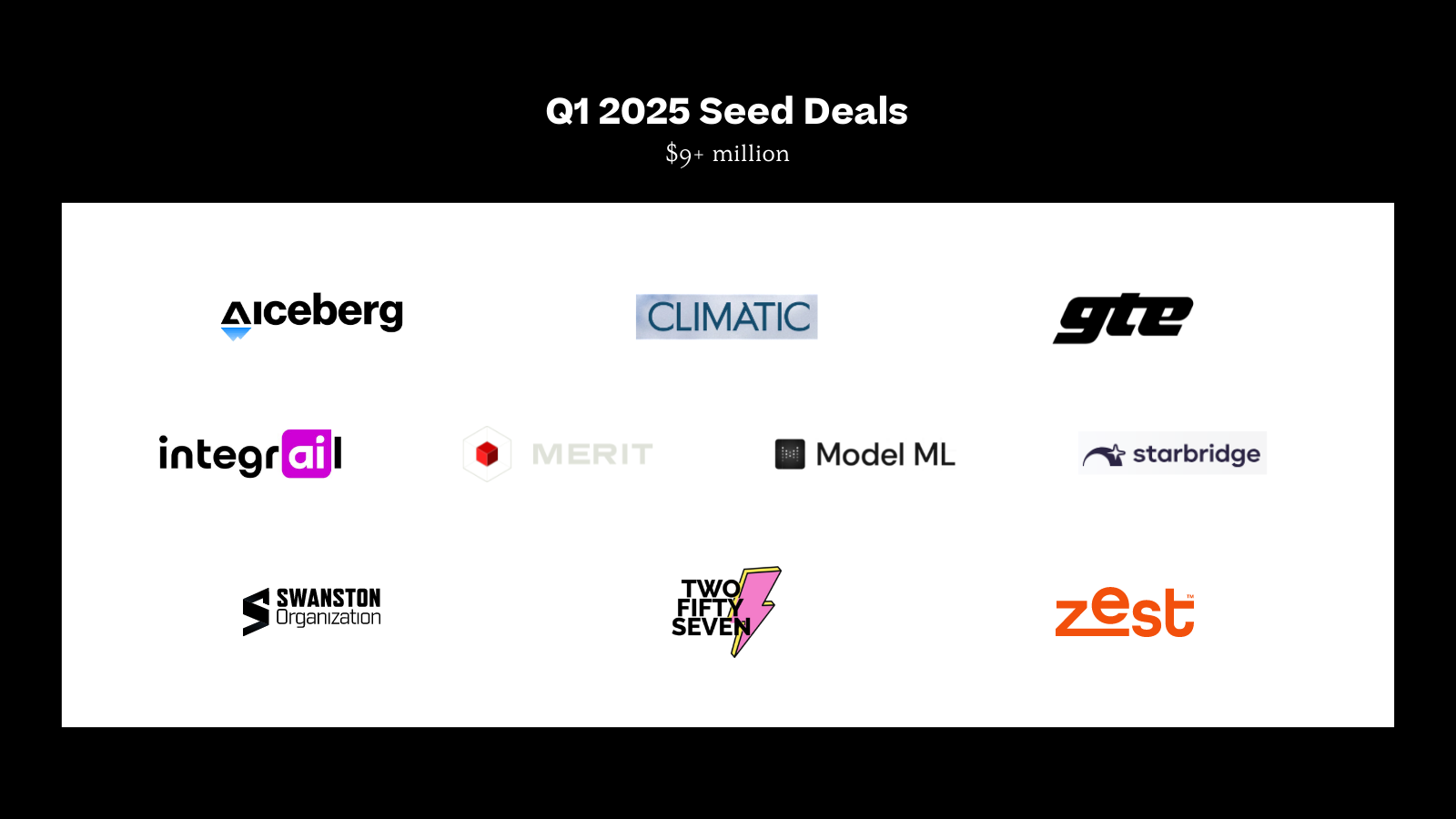

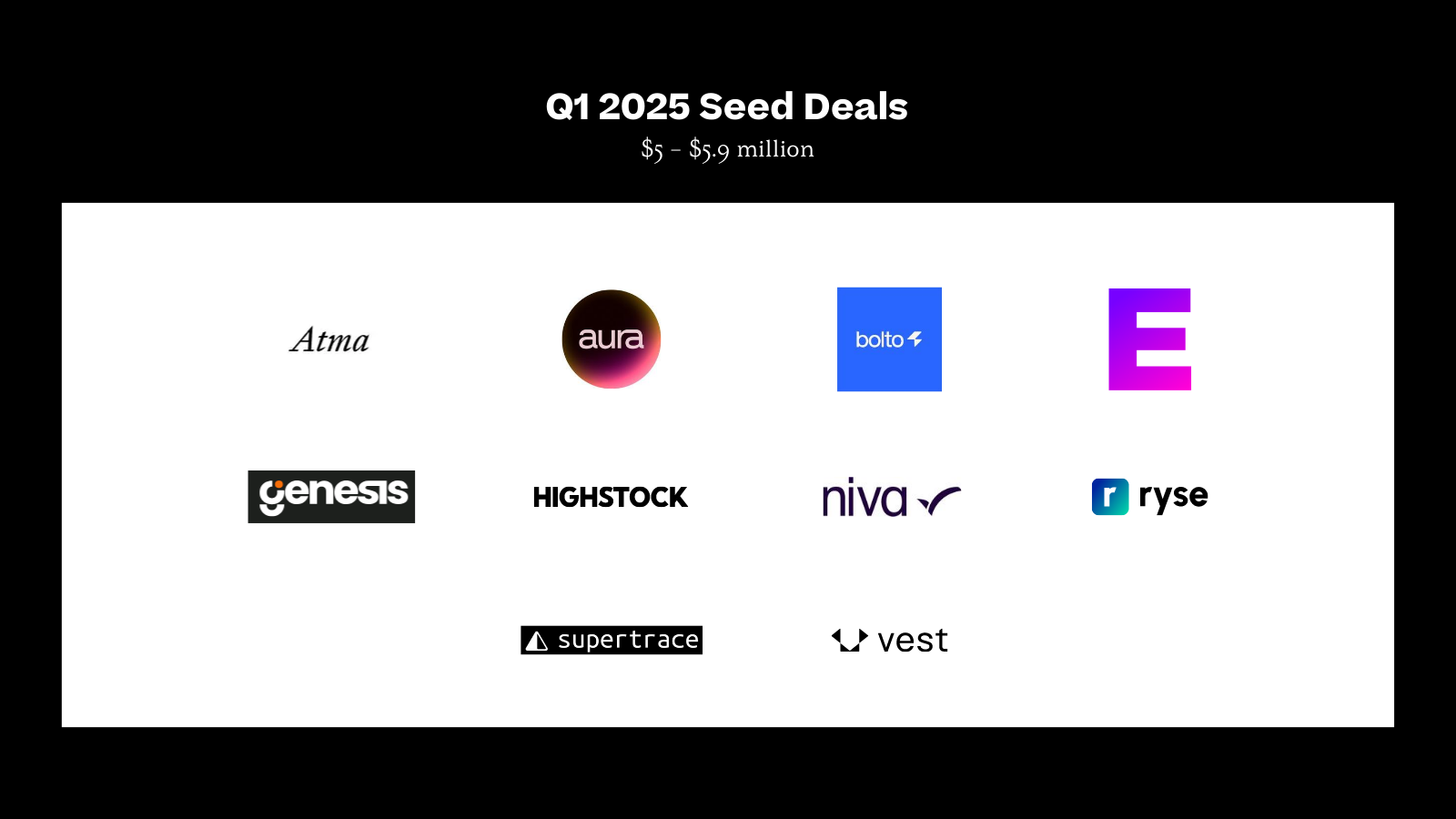

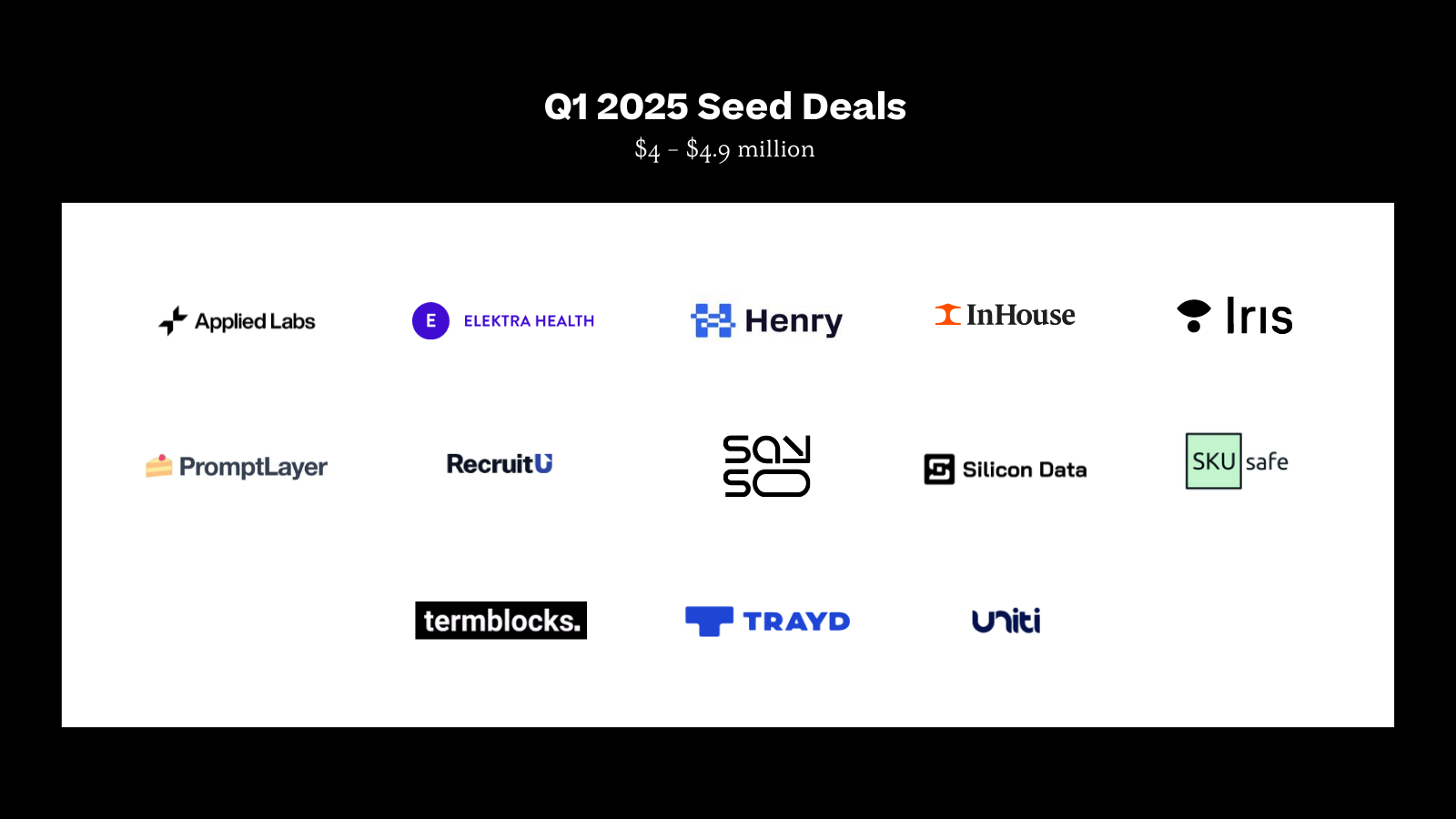

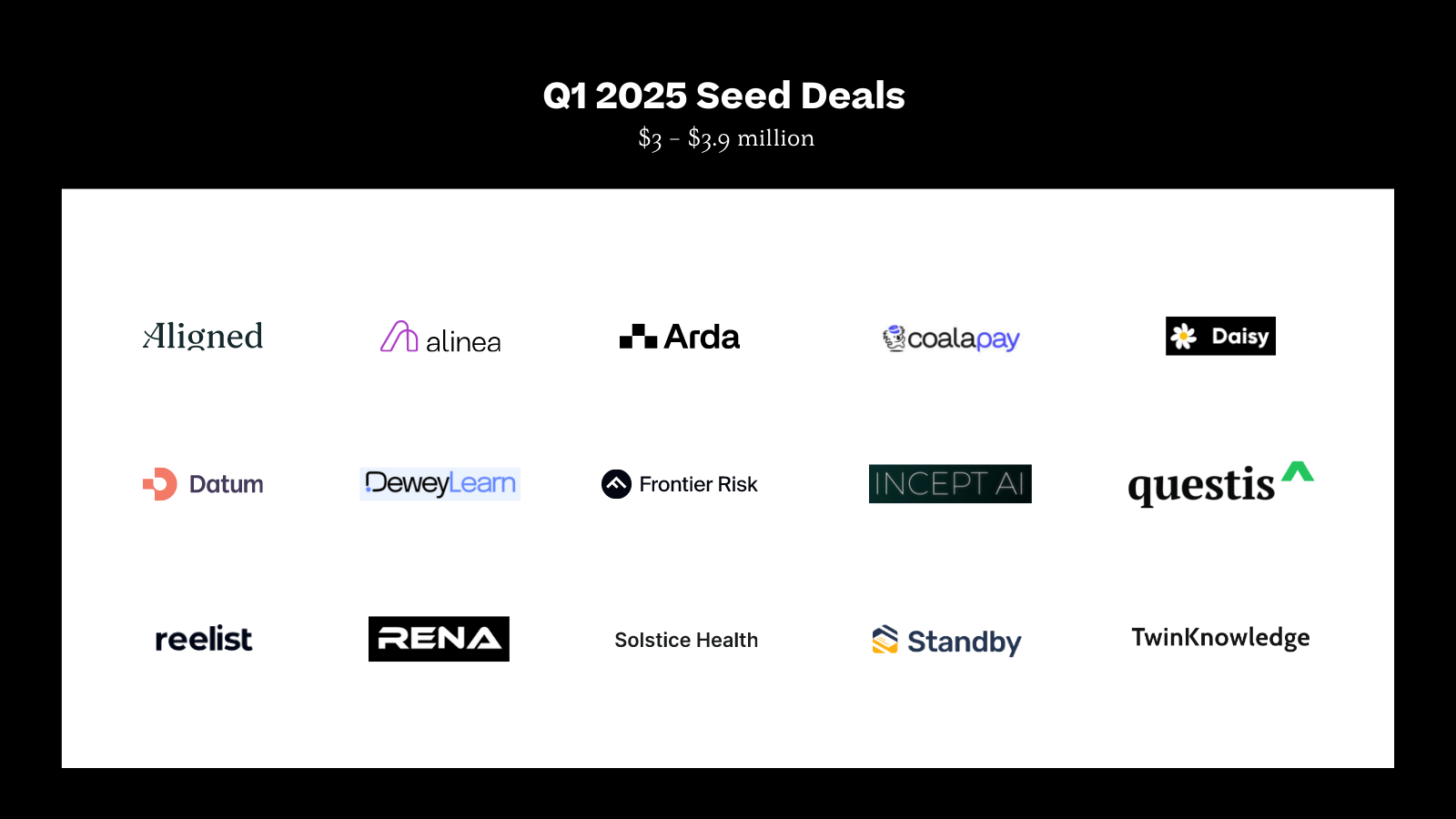

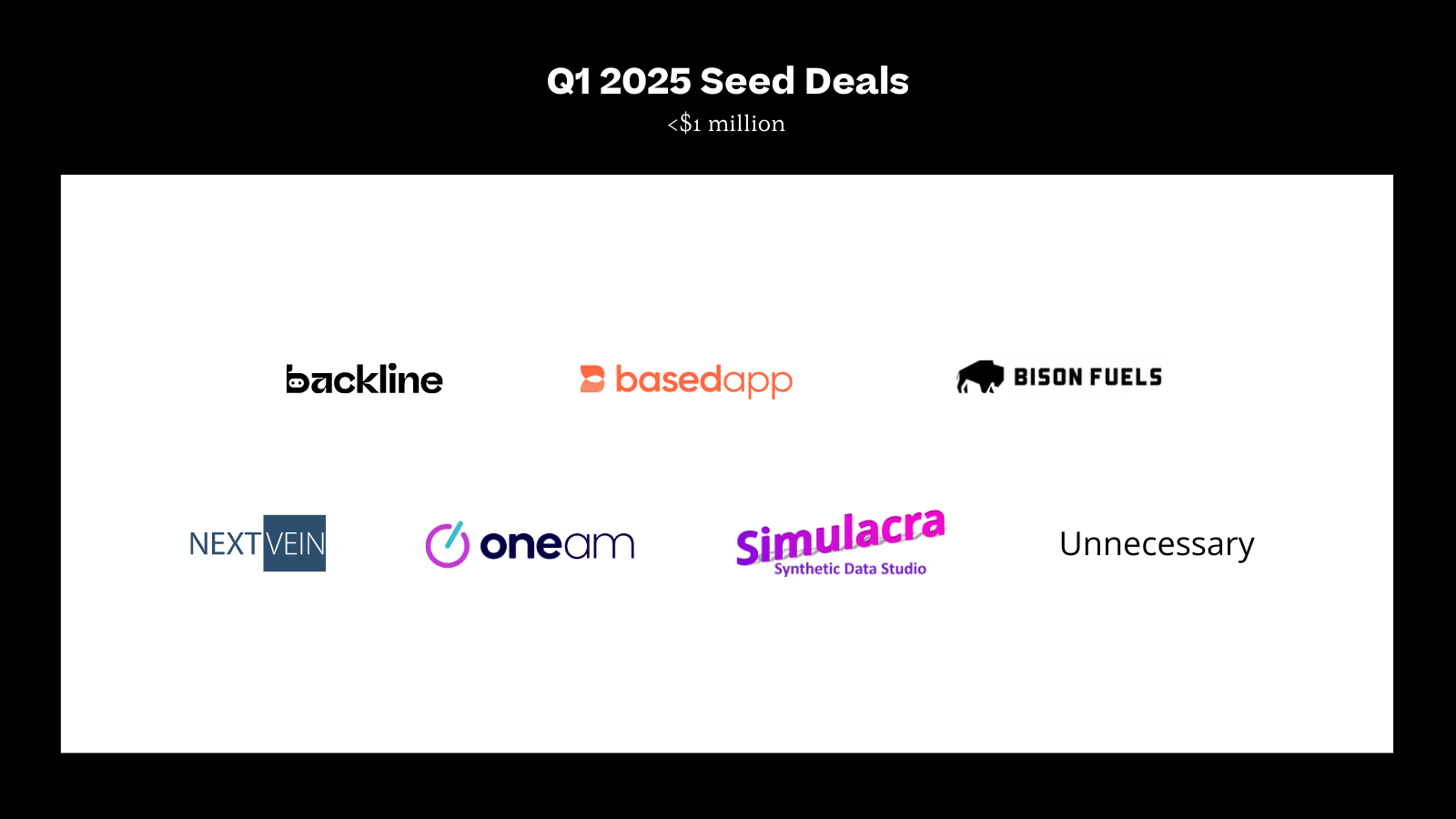

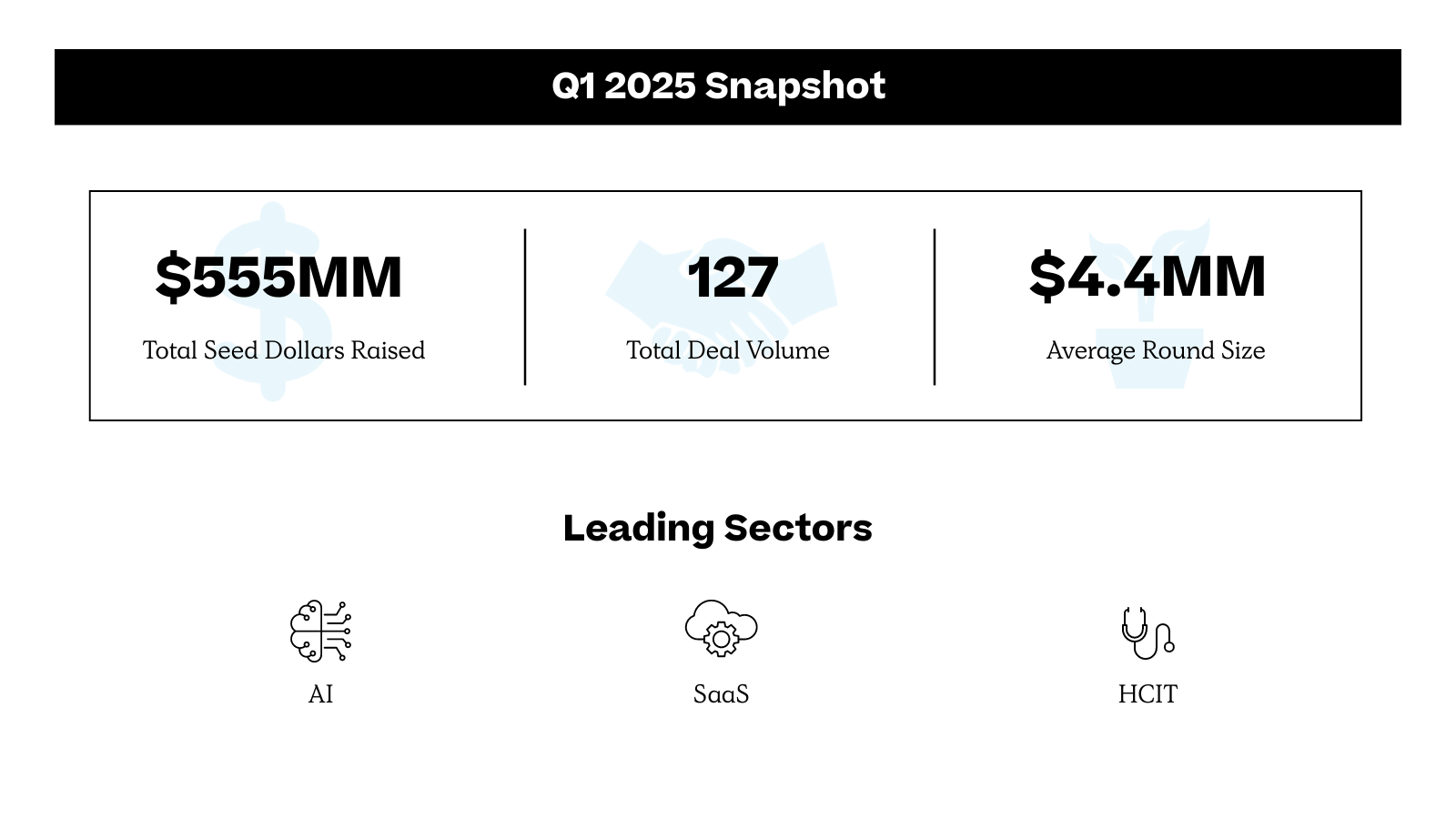

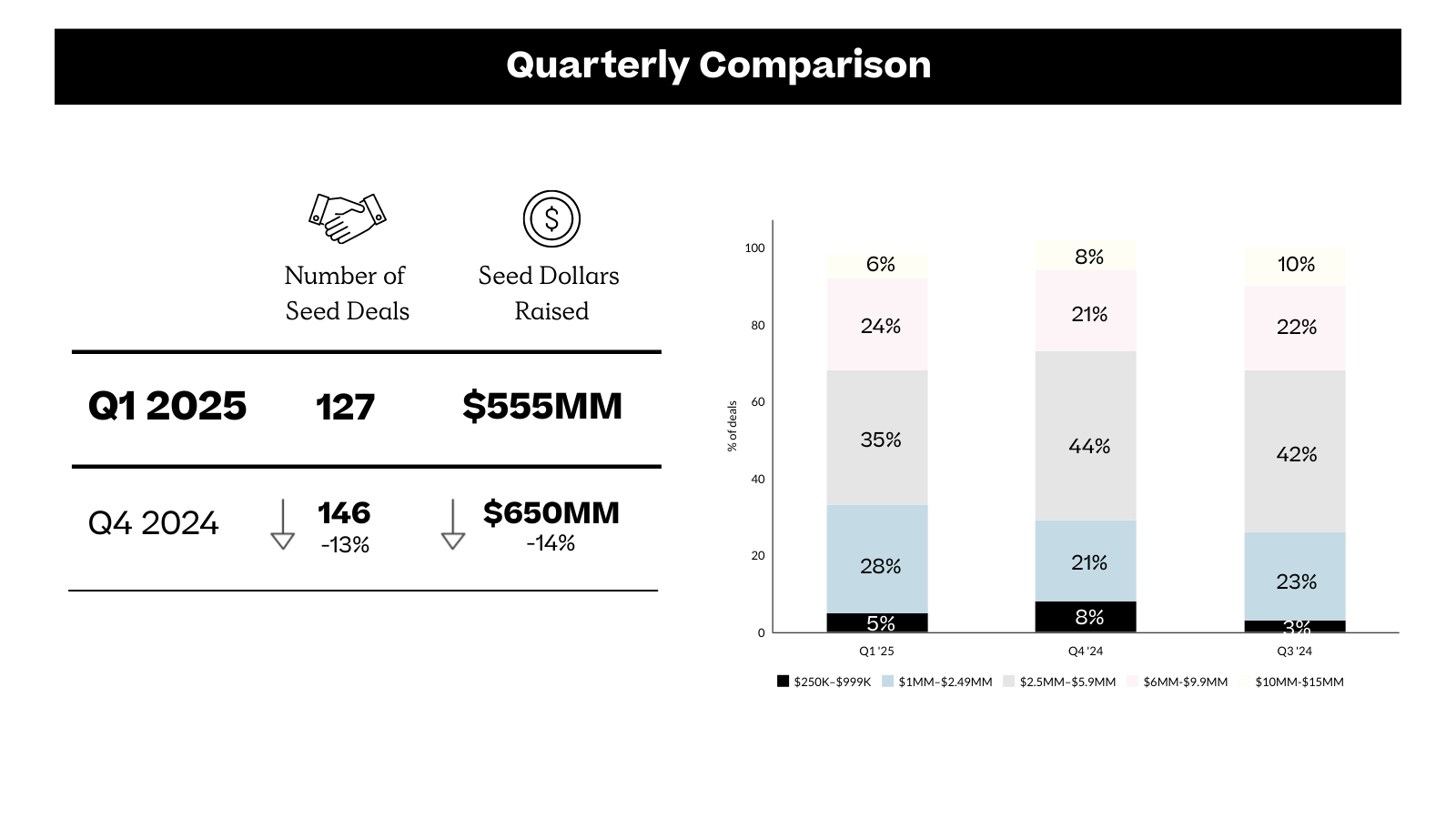

The NYC seed fundraising ecosystem saw a more selective start to 2025, with total seed deal volume down 13% from Q4 2024. However, the market remained strong in conviction—average round size held steady quarter-over-quarter and increased by 15% compared to Q1 last year, rising from $3.8 million to $4.4 million.

AI deals continue to dominate the landscape, accounting for 1 in every 5 deals this quarter. The momentum in the space remains strong, with nearly a third of all funded companies referencing AI in their descriptions. On average, companies we categorized as AI raised 23% more than the rest of the data set—$5,178,502 compared to $4,210,802

Healthcare deals also saw a notable uptick, with deal volume jumping 33% from 12 in Q4 to 16 in Q1, signaling renewed interest in tech-enabled care and infrastructure innovation.

While overall deal count softened, the rise in average check size and continued AI strength reflects a market environment favoring fewer, more conviction-driven bets. The evolving seed landscape continues to reward founders who are solving deep, industry-specific problems with AI as the core engine.

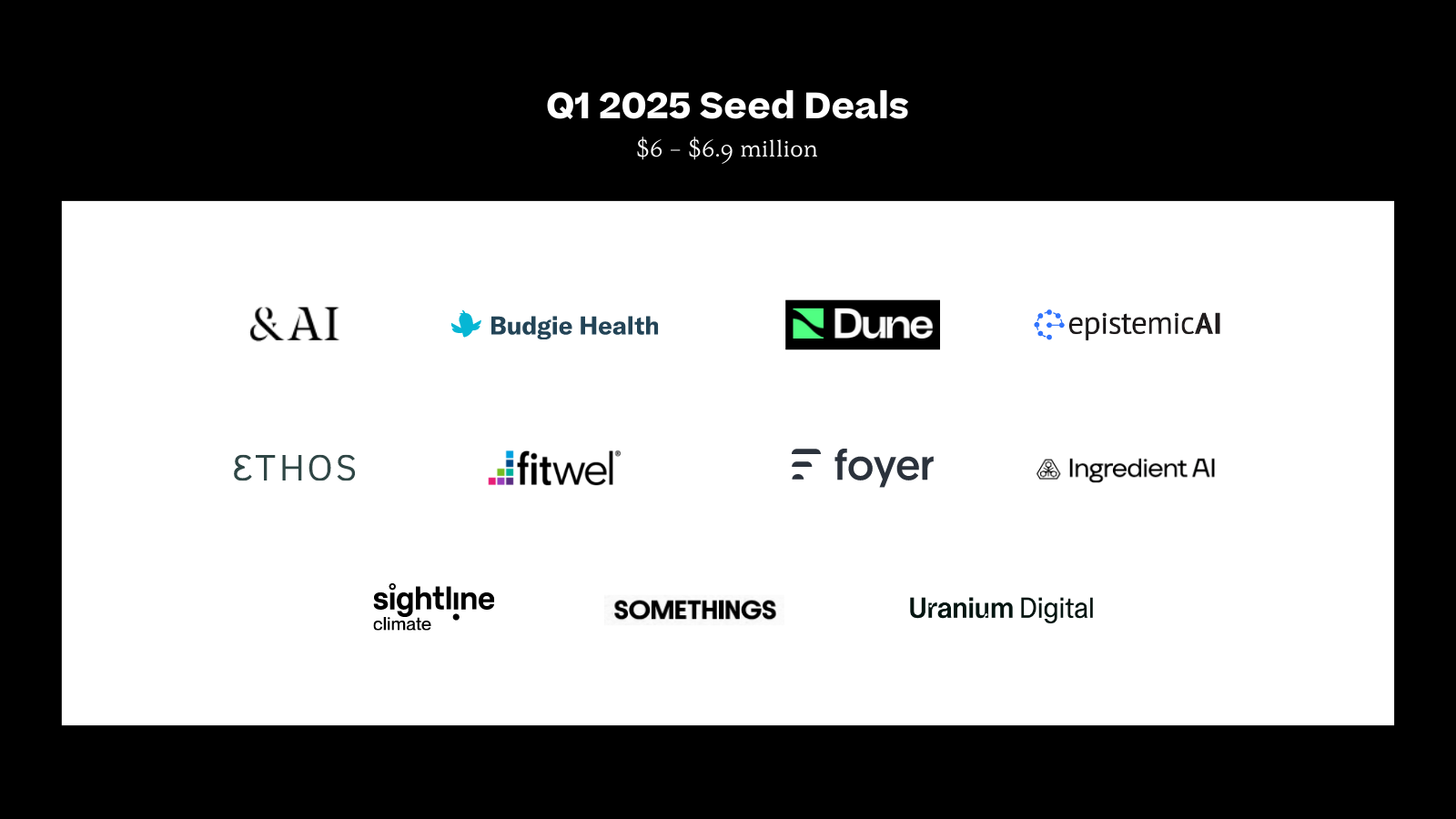

While 2024 felt like the year of the app layer, the first quarter of 2025 gives us some strong indications that investors are continuing to look deeper in the stack for opportunity, beyond just traditional software infrastructure. Getting “closer to the metal” has been an area that investors have been cautious of, due to incumbent pressure and technical risk, but with the massive compute demand that AI has unlocked, more investors are now leaning further down the stack.

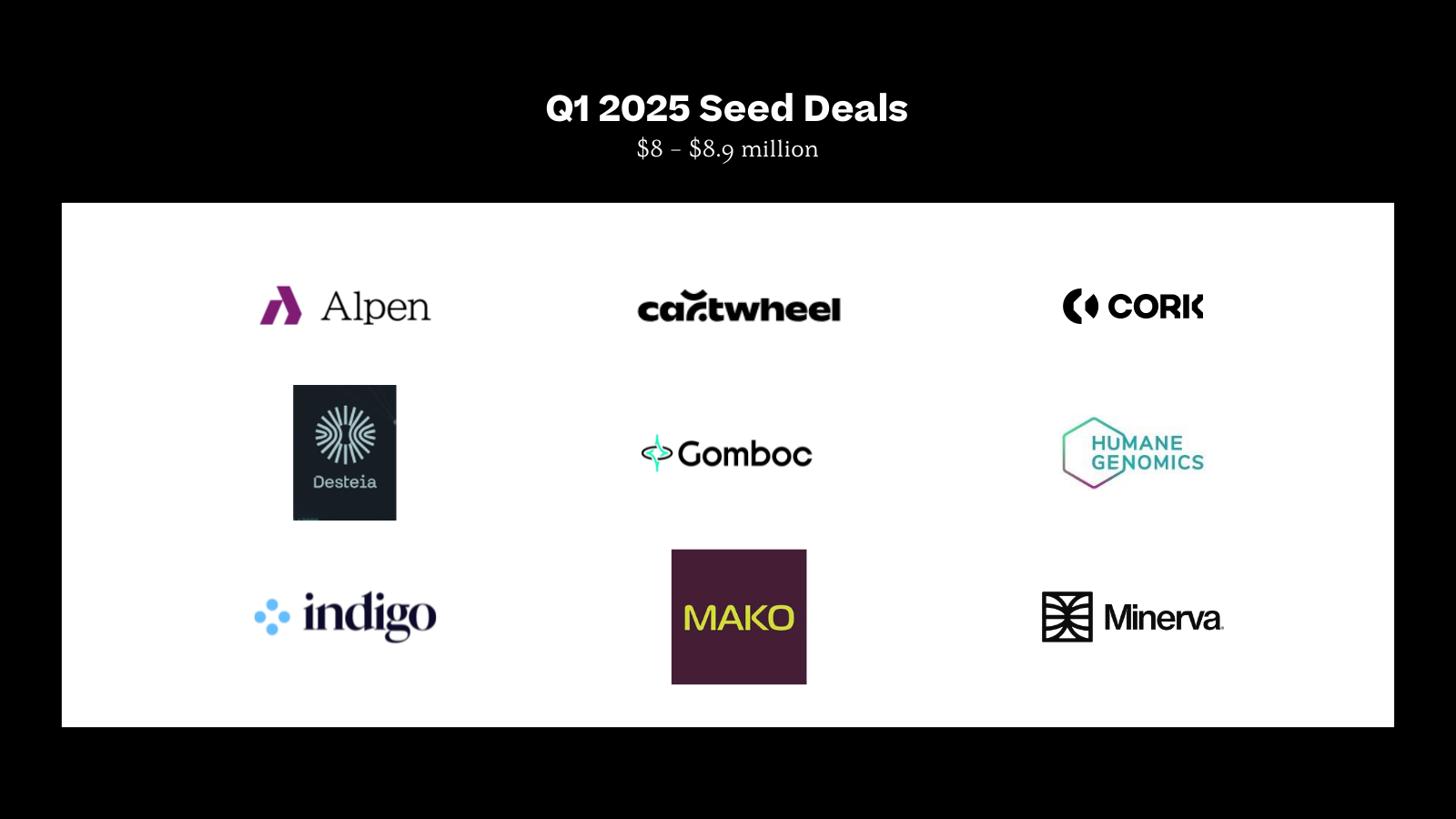

This quarter, Mako announced an $8.5 million seed round for its software product that acts as a universal compiler, enabling AI workloads to run seamlessly across different hardware without requiring code changes. This innovation allows workloads optimized for Nvidia’s best-in-class hardware—often difficult to acquire due to high demand—to be easily ported to AMD and other alternatives. Similarly, Silicon Data is also building software that focuses on the hardware at the center of the AI revolution. The company raised $4.7 million from Jump and DRW to build a data set around GPUs, including carbon emissions data, historical pricing, and performance metrics. By standardizing and centralizing this data, the industry can achieve greater transparency in performance and power usage, ultimately driving further innovation.

As AI continues to push the boundaries of computational power and infrastructure, investors are increasingly betting on solutions closer to the metal, recognizing the enduring value and long term durability.

As healthcare software continues to decentralize, investors are doubling down on tech-enabled platforms that serve niche patient populations with complex care needs. Lizzy Care announced a $2.7 million seed round from Boomerang Ventures to reimagine dementia care. It is taking a specialty-focused approach to provide comprehensive support for patients and their families, ranging from provider communication, medication management, and caregiver support-tailored specifically for the dementia ecosystem.

Zest Health is another such personalized platform, focused on dermatological care. Patients gain access to certified dermatologists, individualized treatment plans, 24/7 messaging, and ongoing monitoring. The company raised $13 million from Roivant Sciences to supercharge its go-to-market strategy and build deeper provider partnerships.

While horizontal solutions may serve broader market sizes, they can be outperformed by vertical players in complex, regulated environments. Specialized care platforms that prioritize patient-centric outcomes, integrate deeply into clinical workflows, and address the nuances of chronic or underserved conditions will continue to gain traction. We’re particularly excited by companies that blend scalable tech with high-touch care, delivering value through improved experiences and clinical impact.

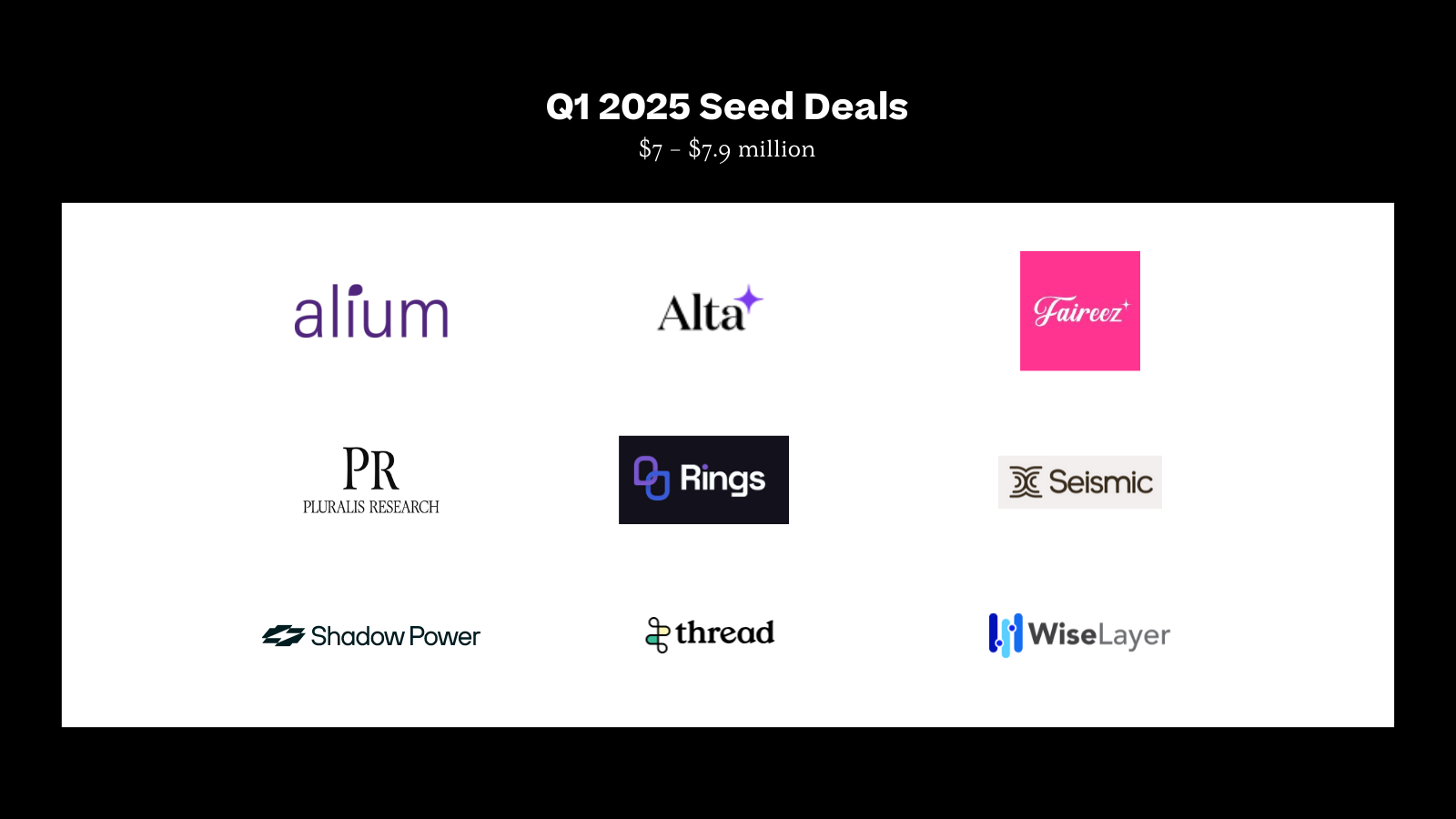

The beginning of the year felt like a period of limbo for clean energy. With an uncertain regulatory landscape ahead, uncertainty rippled across the market—from late-stage financing to government funding and beyond. Yet, despite these challenges, improving domestic energy production remains a compelling and resilient thesis. Shadow Power raised $7.3 million from Silence and Equal Ventures to build modern energy infrastructure, improving grid durability and decarbonization through its “energy-as-a-service” offering. Meanwhile, CapeZero raised $2.6 million to tackle a key part of the energy bottleneck—the complexity and inefficiency of financing energy projects. While modernizing energy infrastructure and streamlining financial processes are key pieces of the puzzle, there’s a lot more ground to cover in the clean energy transition.

We anticipate some slowdowns in funding for energy sources like offshore wind, along with a potential regression toward fossil fuels. However, there is sustained momentum from builders focusing on long-term energy investments, particularly in nuclear and grid technology. Enduring value will be created by solutions that strengthen the existing grid, enable new power generation, and streamline the process of bringing energy projects online—across all types of energy, clean or otherwise.

Despite massive fundraises totaling over $200 million into Hebbia and Rogo from Thrive, Khosla, Index, and others, VCs remain bullish on companies leveraging AI to automate workflows in financial fields. ModelML, which raised a $12 million seed round from Phoenix Court and YC, is building AI based agentic workflows across all systems and data sources at financial institutions. Wiselayer, which raised a $7.2 million seed round led by Canaan Partners, is building AI workers that automate specific complex tasks performed by finance and accounting teams.

While Hebbia and Rogo are providing more of a flexible co-pilot experience to finance workers, this crop of recently funded seed companies are taking on a more opinionated stack tied to the day to day workflows of these professionals. While we think there is value in both approaches, most financial firms today are still testing and iterating on their AI strategy. The winner or winners in this space will be the companies that provide tangible value to these firms, likely in the form of deep and valuable insights that impact their investment strategies.