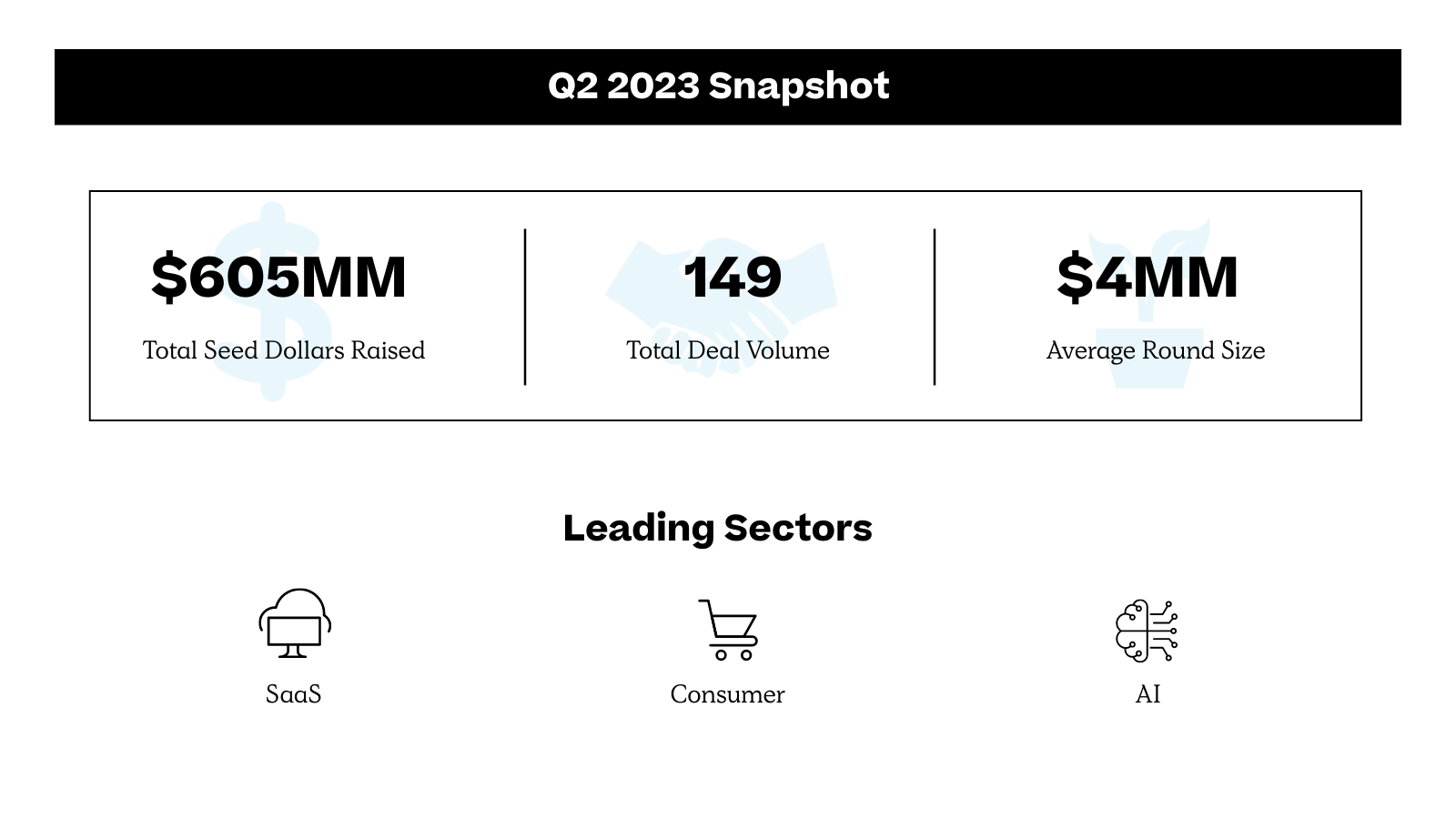

NYC Seed Deals Trade Volume for Round Size in Q2

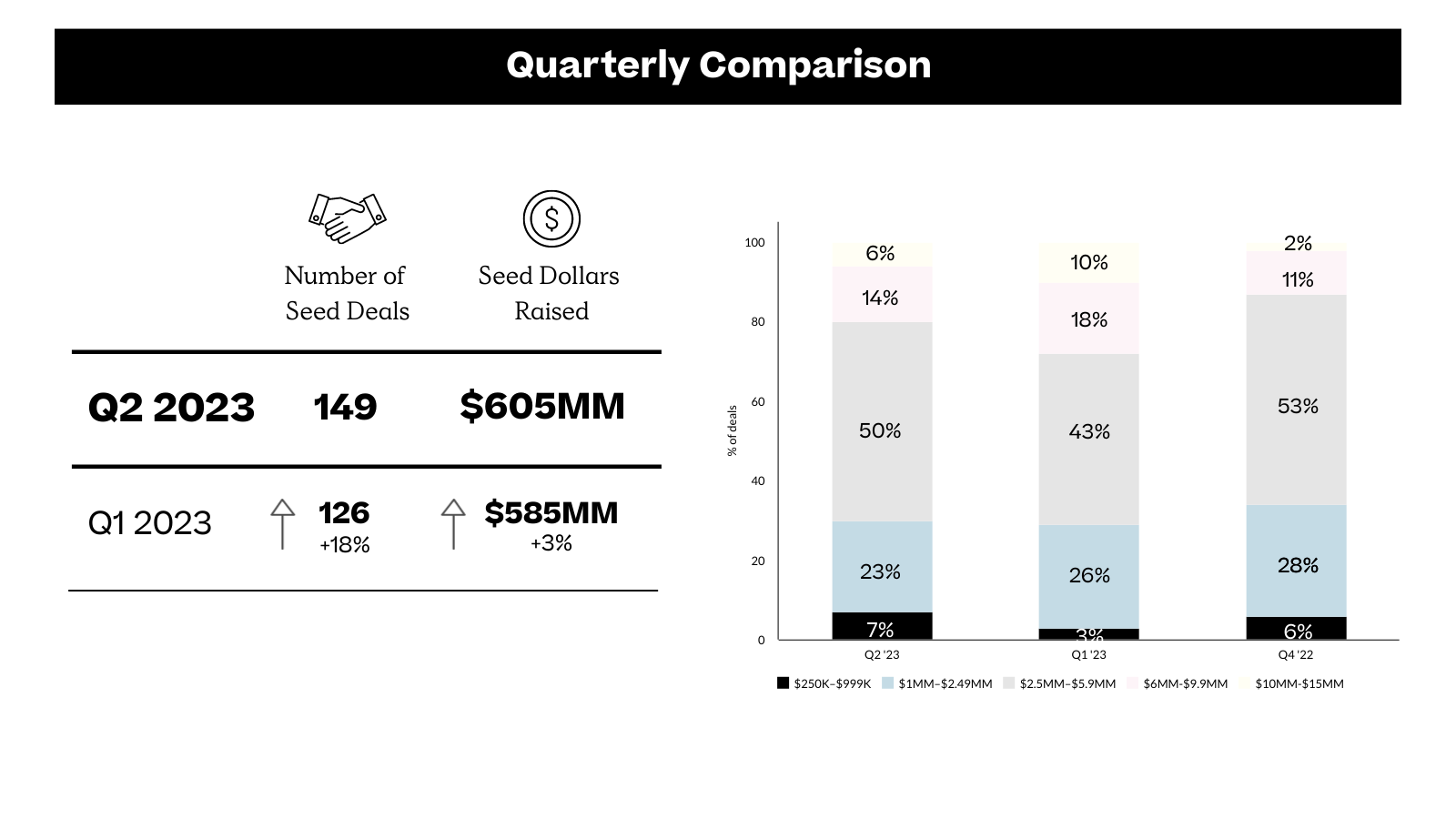

As the total number of deals ticks up 18% this quarter, the average amount raised declined by 13%.

While the U.S. venture market as a whole continues its cool off from pandemic-era peaks, the seed market has remained surprisingly sticky.

Median post-money seed valuations in the U.S. remain high, slightly dipping this quarter for the first time since Q1 2020 (though we’ve seen anecdotal evidence of modest softening over the past few quarters), down ~15% quarter-over-quarter. Meanwhile, Series A valuations are dropping off from Feb ‘22 highs of $68 million, now at $45.8 million as Q2 wraps, a 33% decline. Series B valuations have been more volatile, but following Feb ‘22 peaks ($221 million) and Feb ‘23 lows ($100 million), appear to be rebounding at $125 million—43% down from those highs.

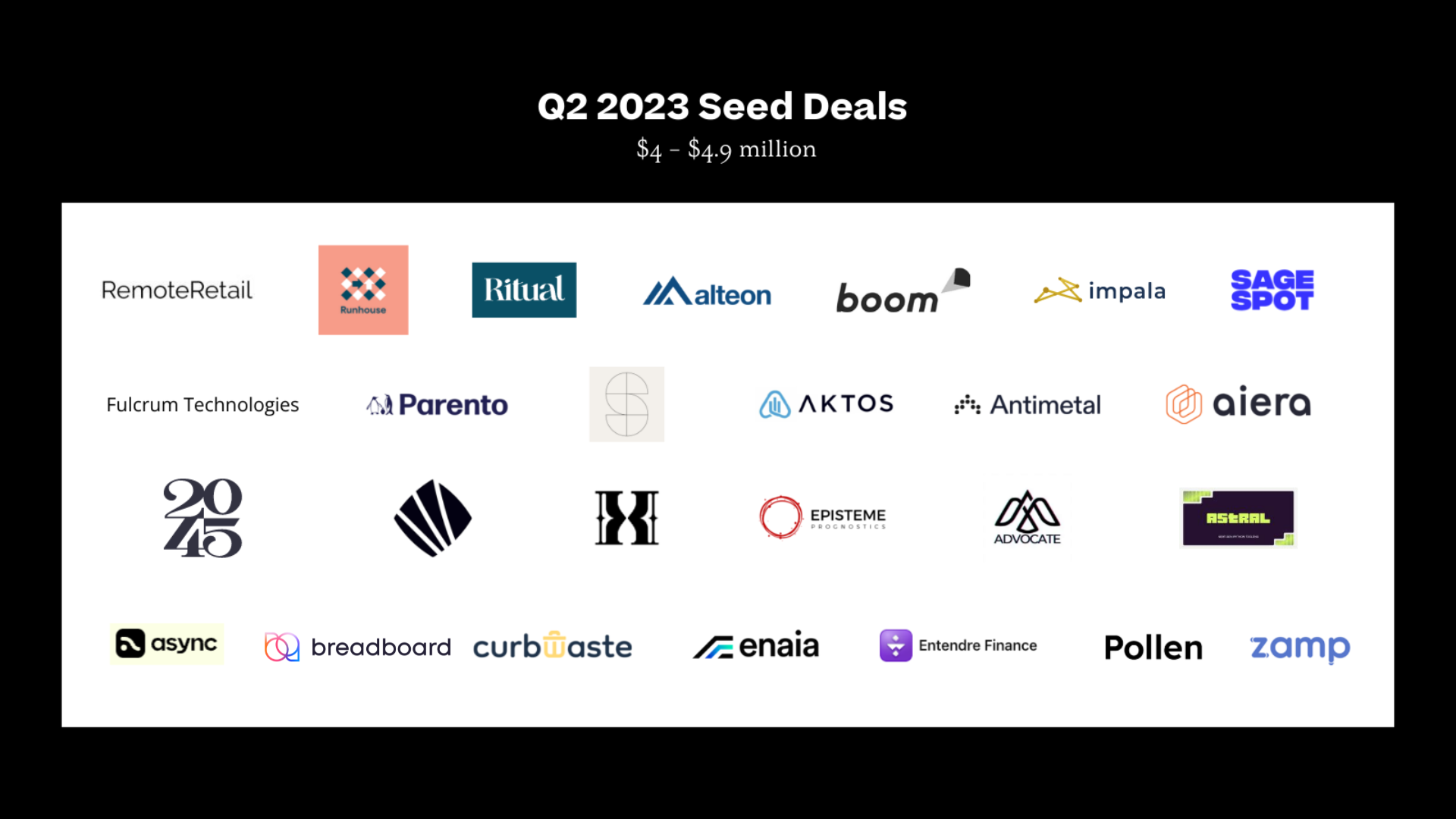

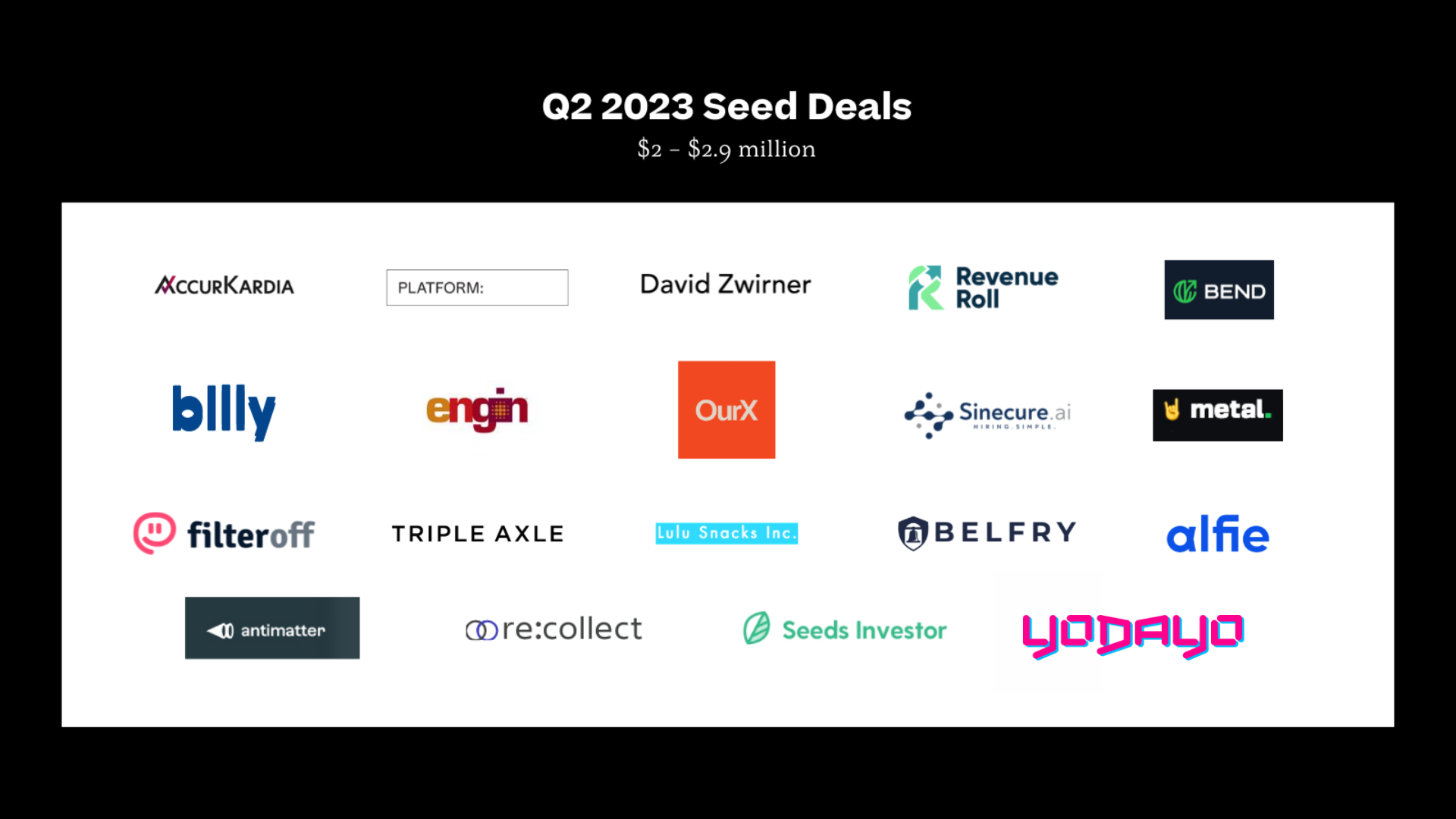

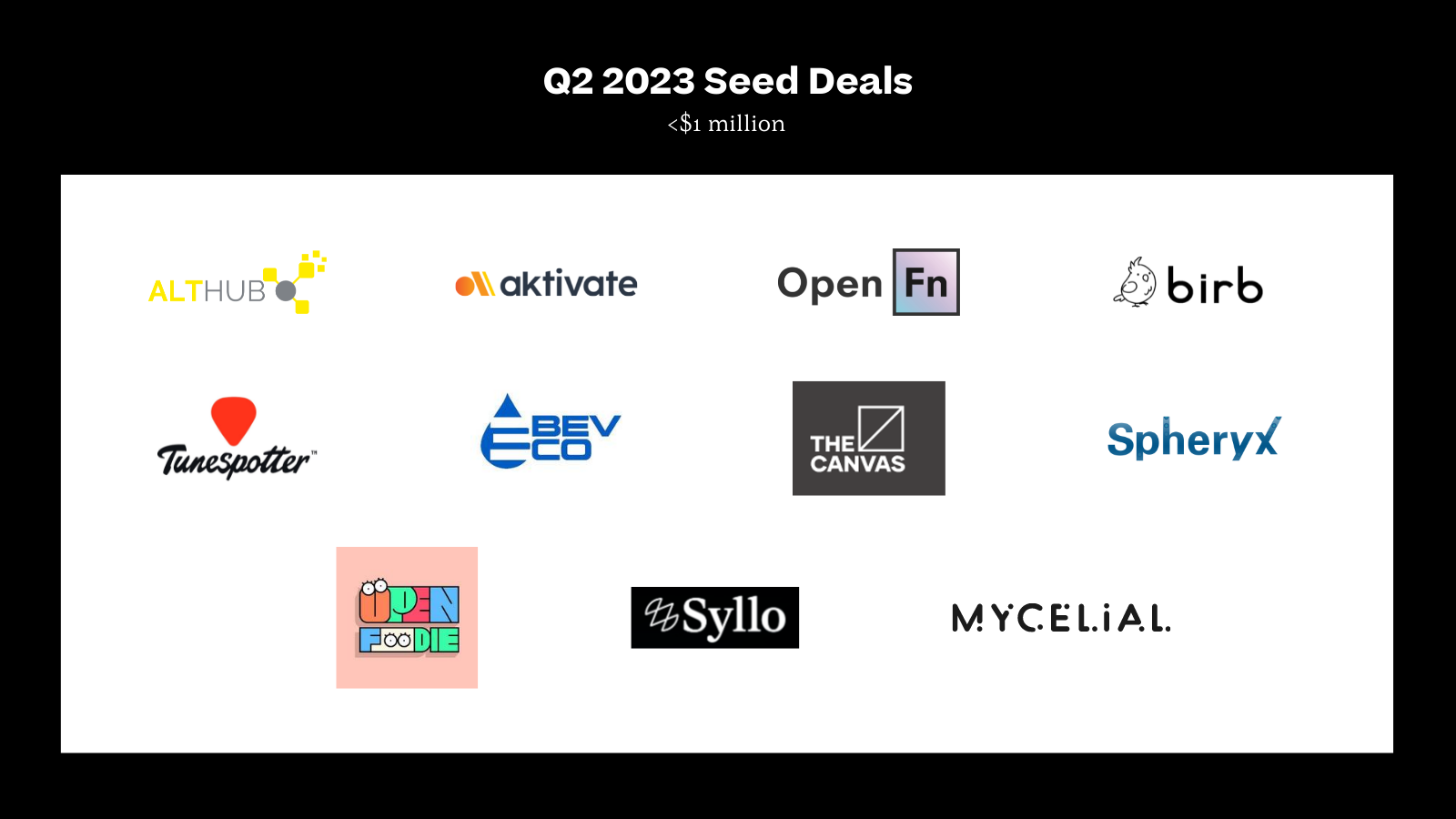

In New York City, Q2 told a slightly more complicated story. Deal volume went up, at an 18% increase, more than it has since Q1 2022. Still, the average amount raised declined by 13%, suggesting the founders who’ve been holding off on fundraising are accepting smaller rounds with slightly less competition from VCs.

And then there’s the AI frenzy. AI deals are up this quarter by 50%, from 10 in Q1 to 15 in Q2. Those deals saw an average seed round of $5.1 million—over $1 million higher than the average round size overall. 40% of those deals were between $6 million and $9.9 million, while only 19% of overall deals fell into that range.

(Our team is tough graders of what’s a truly AI native business—an additional 10 companies self-identified as AI, but we categorized under the sectors to which we see them applying AI technology.)

Here are the sector-specific trends our team spotted in this quarter’s fundraises:

Last quarter we highlighted companies aiming to increase collaboration among physicians. This quarter, we will turn our attention to companies that are helping providers (and their organizations) to have greater autonomy over their own workflows, while streamlining administrative work. With the power of increased automation, we’re seeing platforms that are empowering physicians to shift more focus to patient care versus administrative tasks; with GenAI, we expect to continue to see this trend accelerate. AvoMD, which recently raised $5M, led by AlleyCorp and other investors such as Las Olas, Epsilon Health, Columbia University, and Mount Sinai Innovation Partners is perhaps the best example of this trend. AvoMD indicates it is an AI-enabled, no-code application builder that lets clinicians and hospitals build their own applications that work for nearly any care workflow. Radformation focuses on cancer care, offering tools to streamline the end-to-end treatment planning process, helping providers spend more time on patient care, raised $6.9M from BVP Forge. Last but not least, Populate EMR raised $3.5M to build a specialty-specific EMR complete with AI-enabled workflows to minimize administrative work.

AI has captured the venture capital world by storm, as Large Language Models have enabled new types of AI applications that are more human-like than ever. Amidst this excitement, VCs have also flocked to invest in data infrastructure startups – companies that build the underlying tooling that enables engineers to utilize LLMs and build AI-enabled products. Normal Computing raised ~$8.5M from Celesta Capital, First Spark Ventures, Intel Ignite, and Micron Ventures to help enterprises deploy Generative AI applications with reliability and auditability. How enterprises use LLMs has been a big point of contention, and Normal Computing offers a solution to make that adoption more seamless. DBeaver raised $6.5M, led by Headline, to commercialize a popular open-source universal database tool with deep data management functionality. Lastly, Mycelial raised $300K from Crane Venture Partners to build a connective data layer between cloud and edge. All of these companies are trying to make extracting value out of data easier, and new-age AI models are making the timing right for these sorts of solutions. The data analytics prize is one of the biggest in all of technology. Generative AI has offered a window of opportunity for new entrants to emerge chasing that prize.

Tech resistant sectors have long been a target for vertical software. The biggest success stories have been found in huge markets that are highly fragmented with even more fragmented value chains. Founders are now directing their attention to lesser-known industrial markets, which have been underserved by 21st-century software. Breadboard, which sells procurement software to electronics manufacturers, raised $4M led by Twelve Below. CurbWaste, which is building a vertical solution for waste and recycling management, raised $4M led by TTV Capital with participation from Mucker Capital and B Capital. These are just two good examples. In addition to Breadboard, a number of the companies that got funded this quarter came out of the Fractal Software venture studio, including DashFuel, a vertical solution for petroleum distributors; TripleAxle, a platform for heavy-haul truckers; and Belfry, a security guard management software. In some cases, the wedge products these companies offer have smaller TAMs than other break-out vertical SaaS giants like Toast and nCino. To find venture scale, they rely on their ability to roll out multiple monetization streams in the form of lending, payroll, marketplace transactions, and other services. The market pull for software in industrial categories is undeniable, but time will tell how many “acts” these businesses can really support.