Q2 Seed funding on the rise

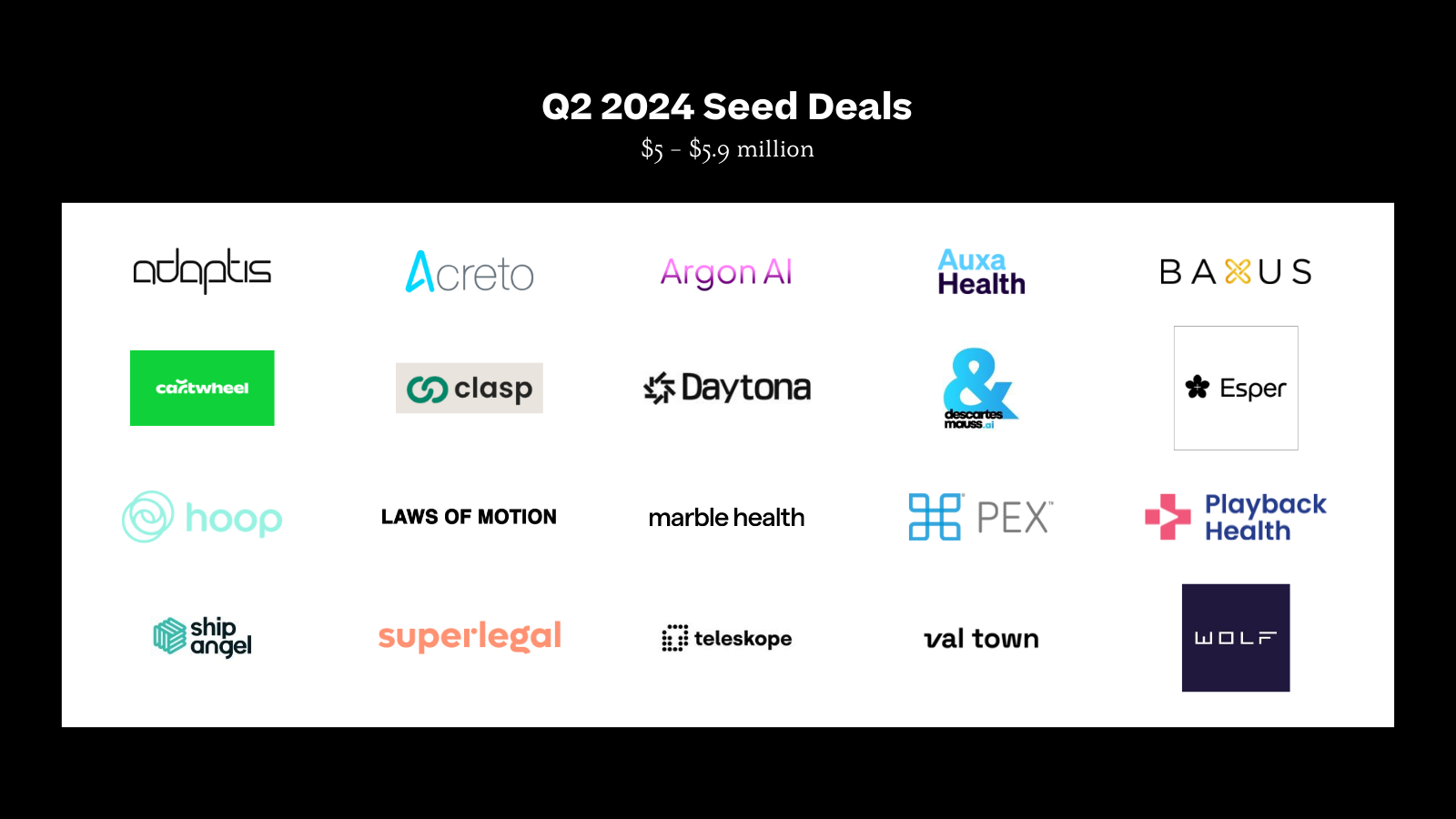

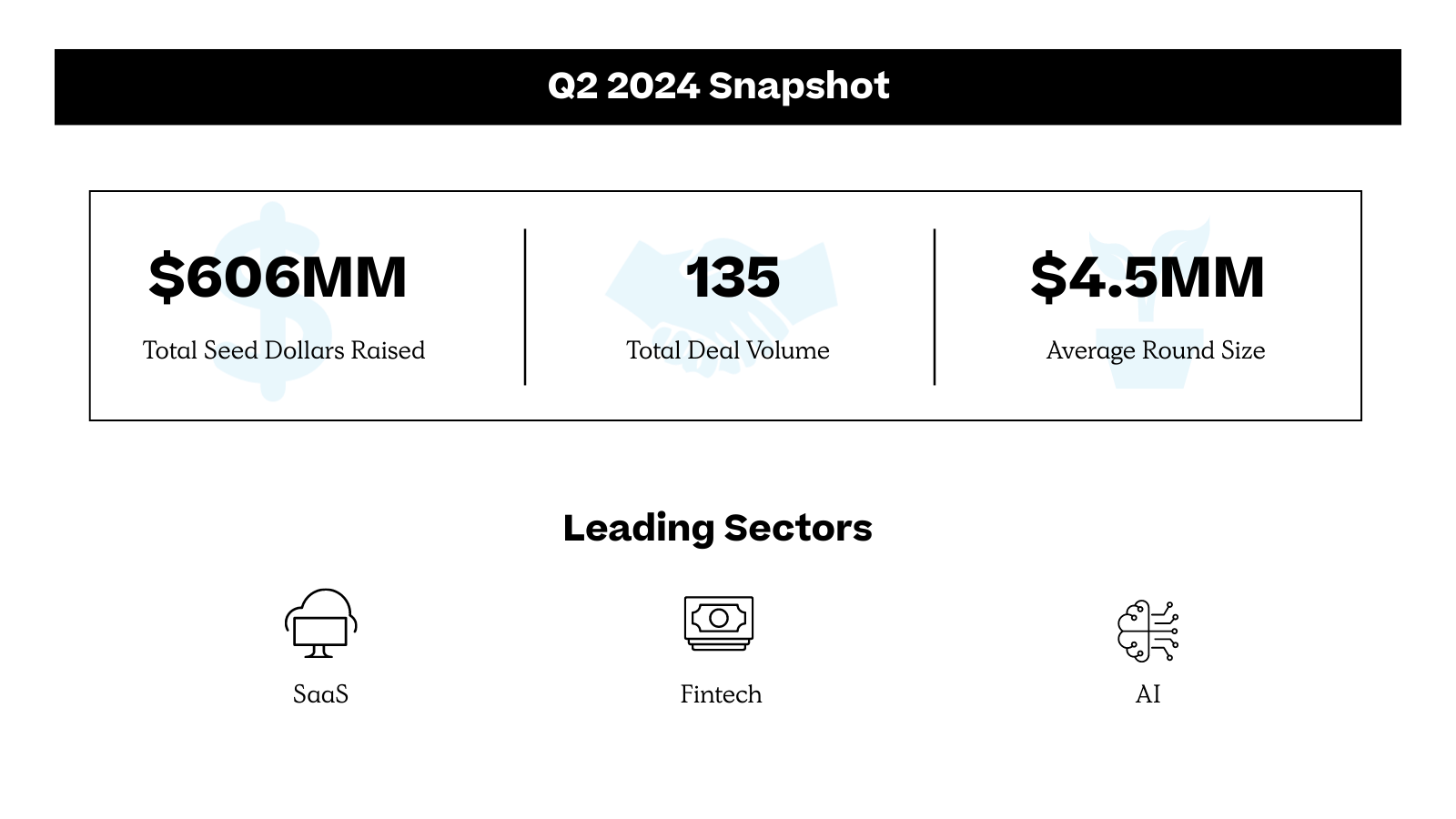

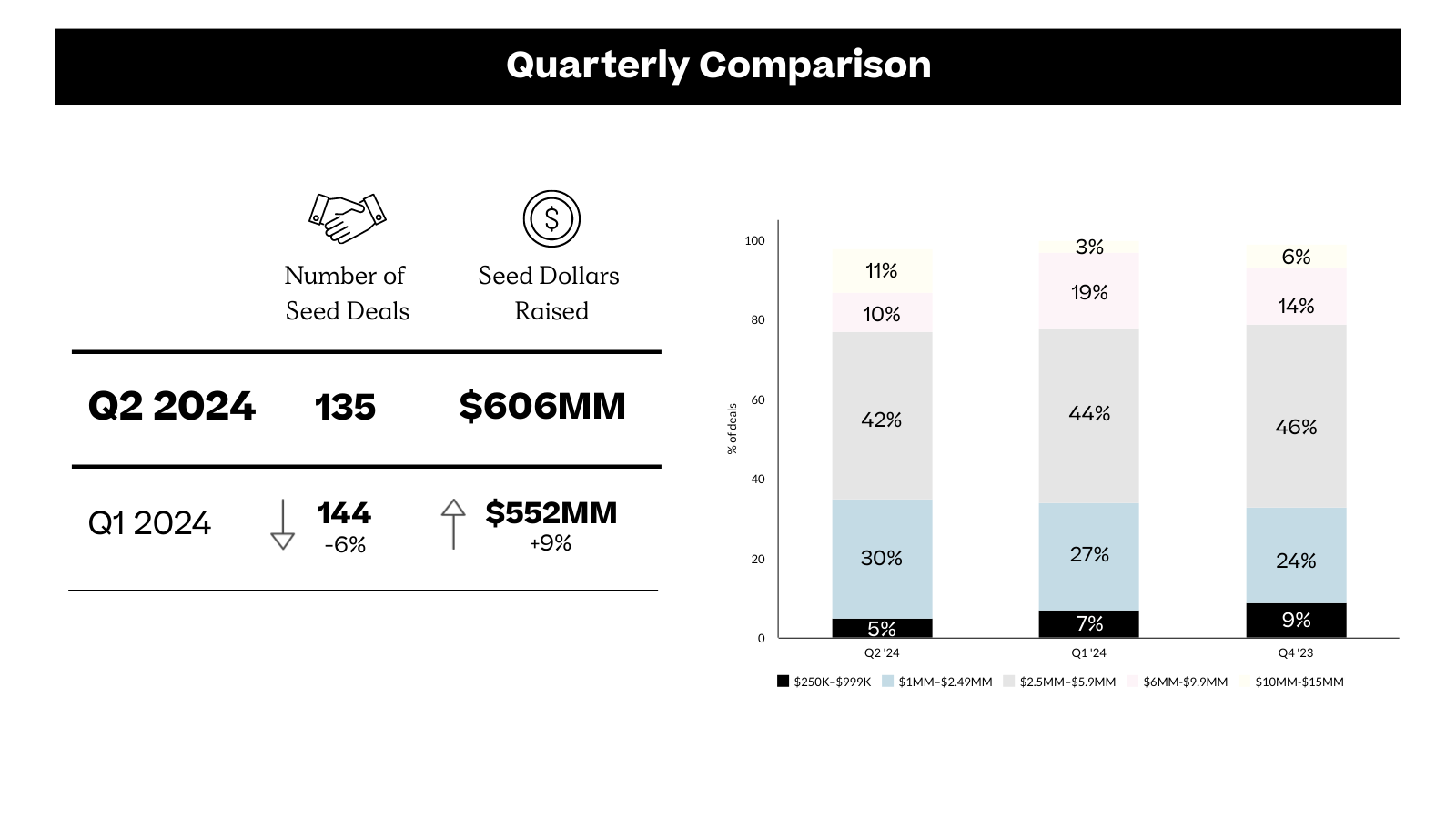

In Q2 2024, the NYC seed fundraising ecosystem saw fewer—but larger—deals. Despite deal volume declining by 6%, total funding saw a 10% rise.

In Q2 2024, the NYC seed fundraising ecosystem saw fewer—but larger—deals. Despite deal volume declining by 6%, total funding saw a 10% rise, highlighting a trend towards larger investments per deal. This is further evidenced by the 17% increase in the average round size compared to Q1 2024.

AI deals showed notable momentum, with a 17% increase from 12 to 14 deals this quarter. Our thesis on AI is that it will continue to become adopted in every industry as a tool for automation. Our lead investment in Etched AI's Series A round, building chips, reinforces this thesis.

AI, SaaS, and Fintech dominated the landscape with 14, 25, and 18 deals each, respectively. Despite the overall decrease in deal volume, the increase in total funding suggests a more selective and strategic approach by investors, aiming for quality over quantity. This quarter's trends underline a robust and adaptive fundraising environment in NYC, poised for further evolution as new technologies emerge.

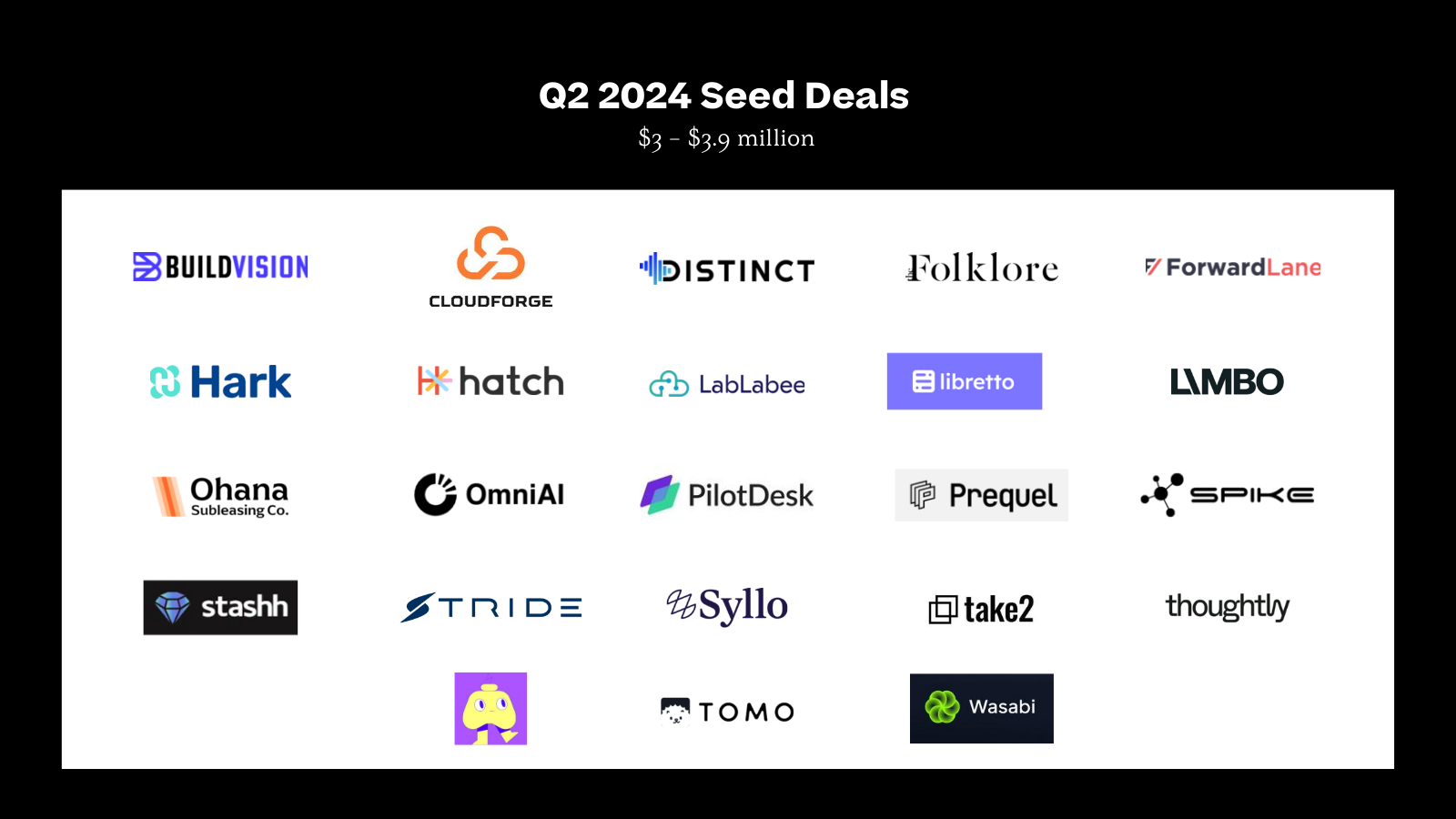

Q2 was a noticeably cooler time for Healthcare deals in NYC as almost half of the fundraises during this time were extensions from previous Seed raises (we believe a number of raises were not formally announced). Despite this, we did see a few trends continue to shine through: AI agents and interoperability between health data from different devices in an attempt to provide a more holistic, continuous care experience. Trovo Health raised a $15M Seed from Oak HC/FT to help providers add new capabilities to their care delivery, specifically through specialty-tailored AI experts, trained on various healthcare workflows. Additionally, Spike secured $3.5M in funding from Practica Capital and TheVentureCity to unify healthcare data from wearables and devices in real-time. Lastly, Limbo Health, raised an additional $3.7M, combining wearable data, AI-based coaching in the buzzy arena of weight management. Overall, we tend to agree that a more holistic and comprehensive data-centric approach is inevitable, but we believe the implementation and consumer experience that’s created will be critical for determining success. We are intrigued to see how these themes advance both quality of care for providers and personal health.

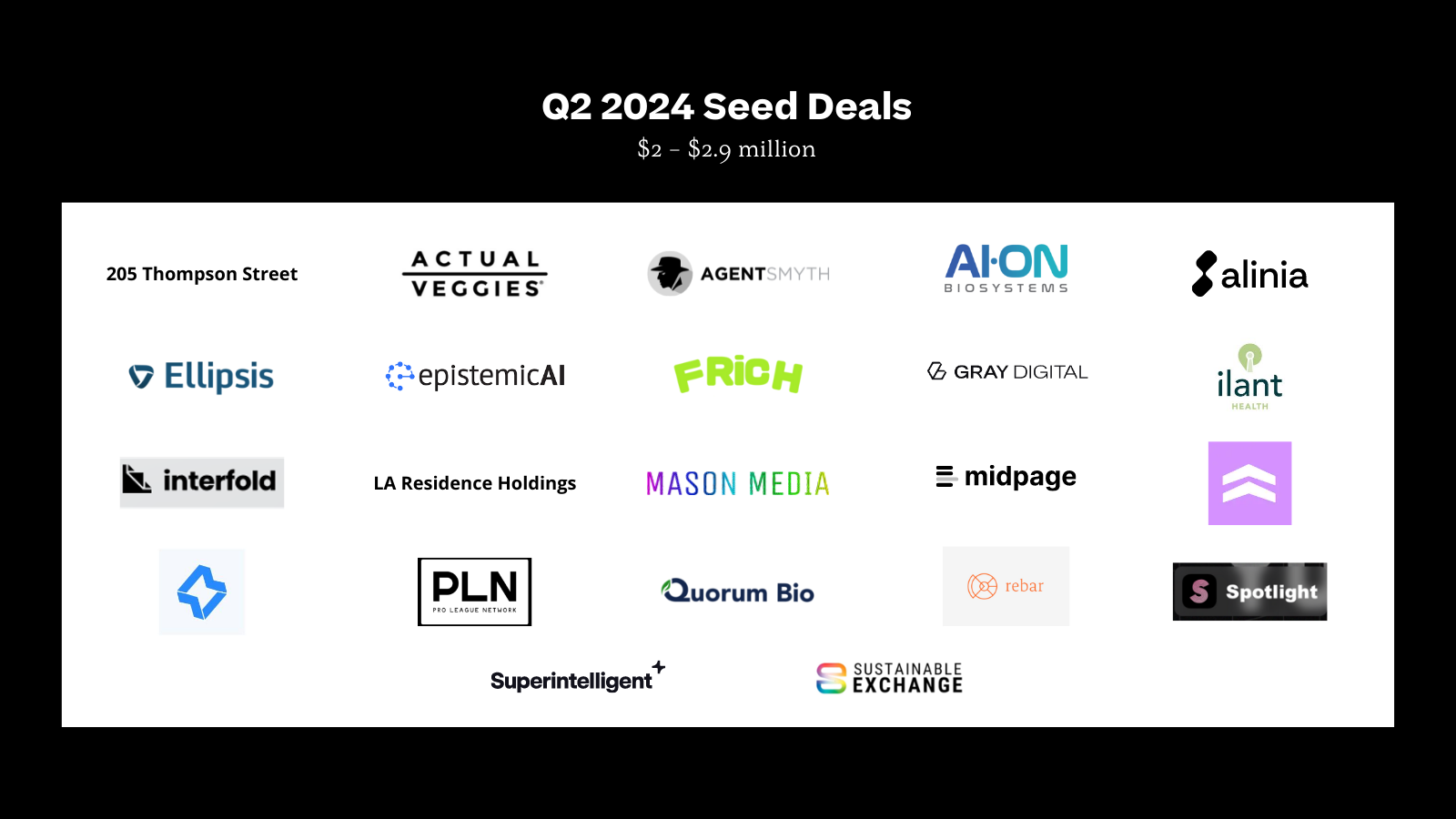

Companies building in the metal, mineral and materials space have gained attention from traditional industrials investors as the regulatory environment continues to incentivize a push for US-based manufacturing and innovation in these industries. CloudForge raised a $3.95M seed this past quarter to build workflow automation for metal service centers, which uphold essential industries like aviation, housing, automotive, and more, encouraging their operational efficiency amidst rising demands for metals. Additionally, Bloom Labs raised $2.8M from Mir Ventures for their breakthroughs in materials science that allow them to convert natural waste by-products into sustainable fibers. We expect that these industries, previously overlooked by many investors in the space, will see an increase in investment over the next few years.

Last quarter we discussed software sprawl leading to dependency sprawl. Another major result of software sprawl is data sprawl. Data sprawl is leaving enterprises largely reactive to monitoring and protecting data stored across multiple clouds and SaaS apps. Teleskope, a data security and privacy automation platform, raised a $5M seed round led by our infrastructure team at Primary. Teleskope’s platform focuses on mitigating the complexity and risk that results from data sprawl across the enterprise. Additionally, Metatate raised $1.1M last quarter to improve collaboration between business, technical and compliance teams looking to remove the complexities around managing legal and regulatory data rules for an organization. As data democratization has become a company-wide priority in the name of innovation, companies are now adopting new technologies like Teleskope and Metatate to react to the realities of handling data across so many environments and end-users.

For the past few quarters, the venture community has taken keen interest in verticalized AI voice agents, backing voice agent startups serving end markets like dentistry, home services, restaurants, and hospitality. However, this quarter, early stage VCs have backed startups taking a horizontal approach to digitizing the contact center. Thoughtly raised a $3M Seed round from Afore, Expansion, and Greycroft to become the “Zapier for contact centers.” Their customizable but intuitive approach to building call paths makes them a great choice for SME contact centers who are looking to augment or downsize their existing call center operations. Similarly, Thread, who raised a $6.55m seed round led by Integr8d Capital, is taking a platform-agnostic approach to customer service, enabling service providers to chat with their customers quickly and on the platforms their customers already work in like Slack and Teams. While we believe the vertical approach to AI voice agents is well suited for startups going after SMBs, we’re excited to see what kinds of technology get adopted by SME call centers. Historically, call center software has taken a horizontal approach to serving enterprise customers and if that continues to be the case, companies like Thoughtly and Thread are well positioned to win the enterprise market.

The B2B world is notoriously complicated. Companies that are laser-focused on cash and profitability are also bogged down by highly manual processes. To remain competitive, businesses seek flexibility and speed in their billing processes. Tabs is an accounts receivable (AR) platform that leverages AI to automate the extraction of contract-related data, ultimately speeding up the payments collection process for B2B businesses. The company emerged out of stealth with a $7M Seed raise led by Lightspeed with continued participation from our fintech & enterprise software team at Primary. Just as Rippling disrupted payroll, Airbase disrupted accounts payable (AP), and Ramp disrupted spend, Tabs is addressing the forgotten module of the modern finance stack by revolutionizing AR. AI has enabled Tabs to unlock access to data that has been buried in contracts, and subsequently understand, structure, and then act on these contracts. We are excited to see how this end-to-end solution enables finance teams to better understand the customer and create quicker time to value.