Q3 Sees Bigger Bets on Deals While Overall Deal Count Dips

In Q3 2024, the seed fundraising landscape experienced a significant shift. Dive into the trends we see in this quarter's NYC Seed Report.

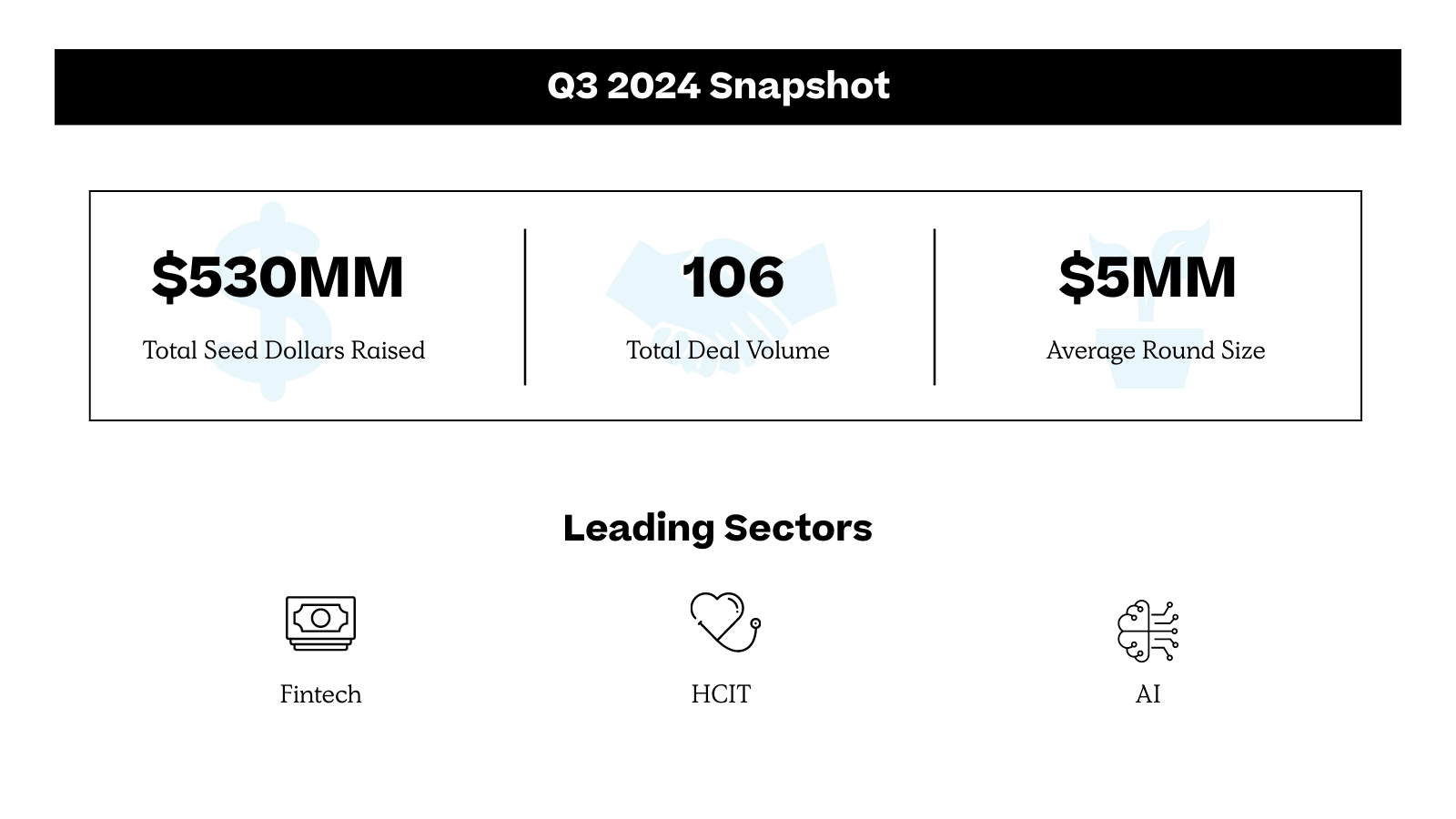

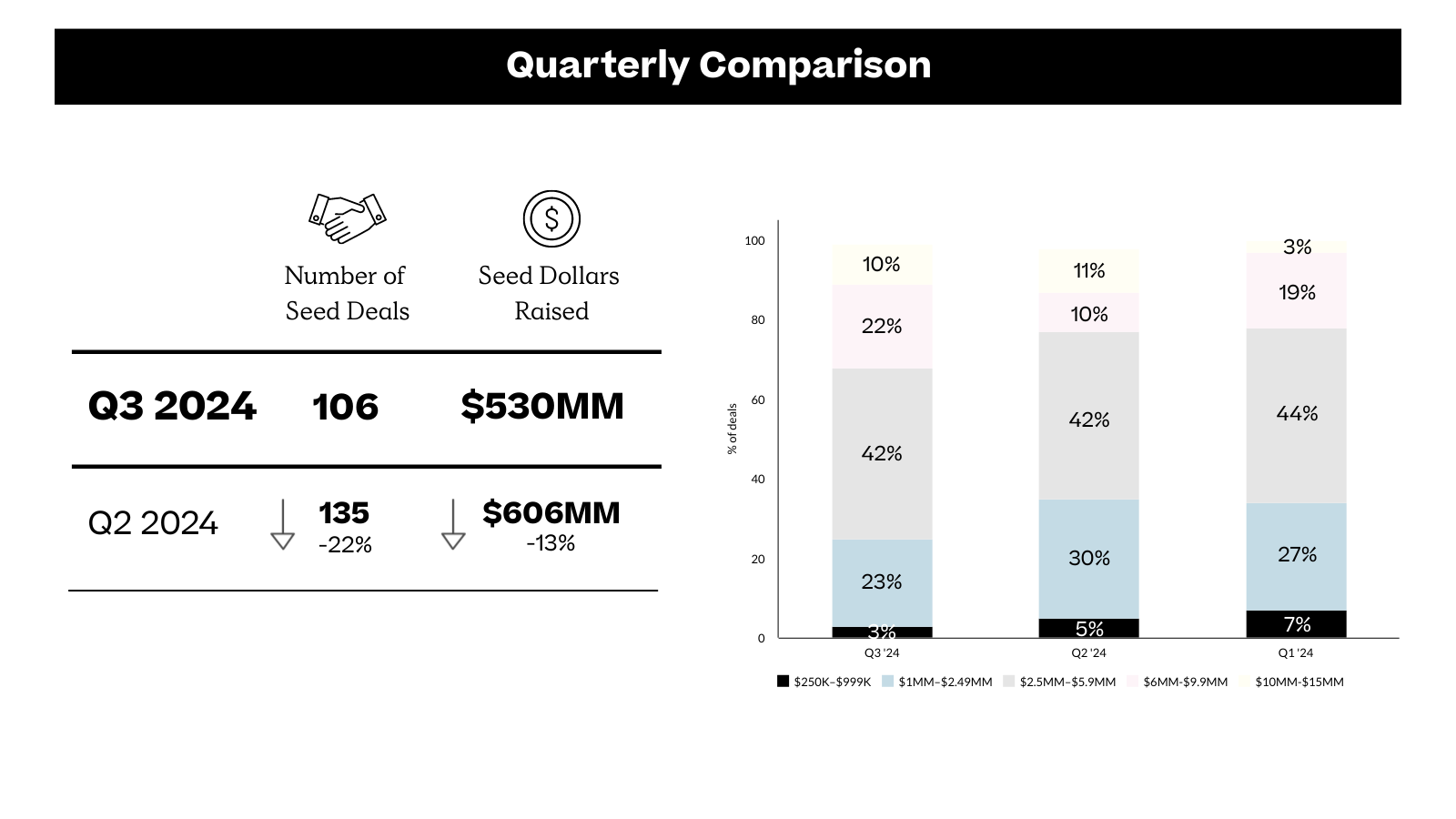

In Q3 2024, the NYC seed fundraising landscape experienced a significant shift. Total funding decreased by 13% from the previous quarter, reflecting a more cautious market sentiment. However, the average round size rose by 11%, increasing from $4.5M to $5.0M. This trend indicates that investors are adopting a high-conviction, low-volume approach.

Healthtech (HCIT) deals saw notable growth this quarter, rising from 13 to 16 transactions. Together with AI and FinTech, HCIT accounted for nearly half of all deals in Q3. A key trend was the increase in deals within the $6M-$10M range, which grew from 10% last quarter to 22% this quarter, underscoring a shift toward larger funding rounds.

These trends highlight a strategic change among NYC investors, who are now favoring quality deals with higher average investments in key sectors. This evolving environment reflects a readiness to support higher-value opportunities as new themes emerge.

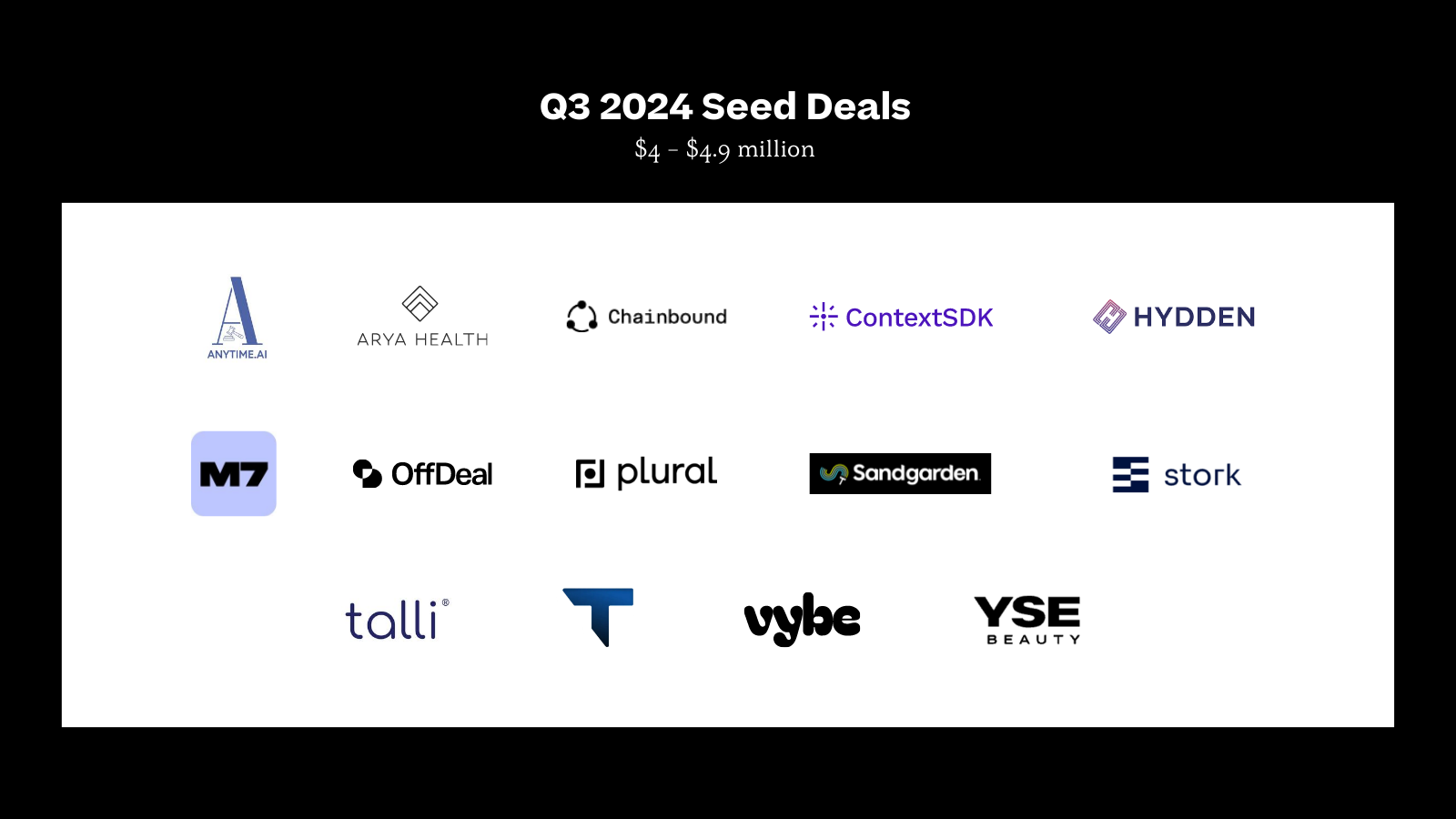

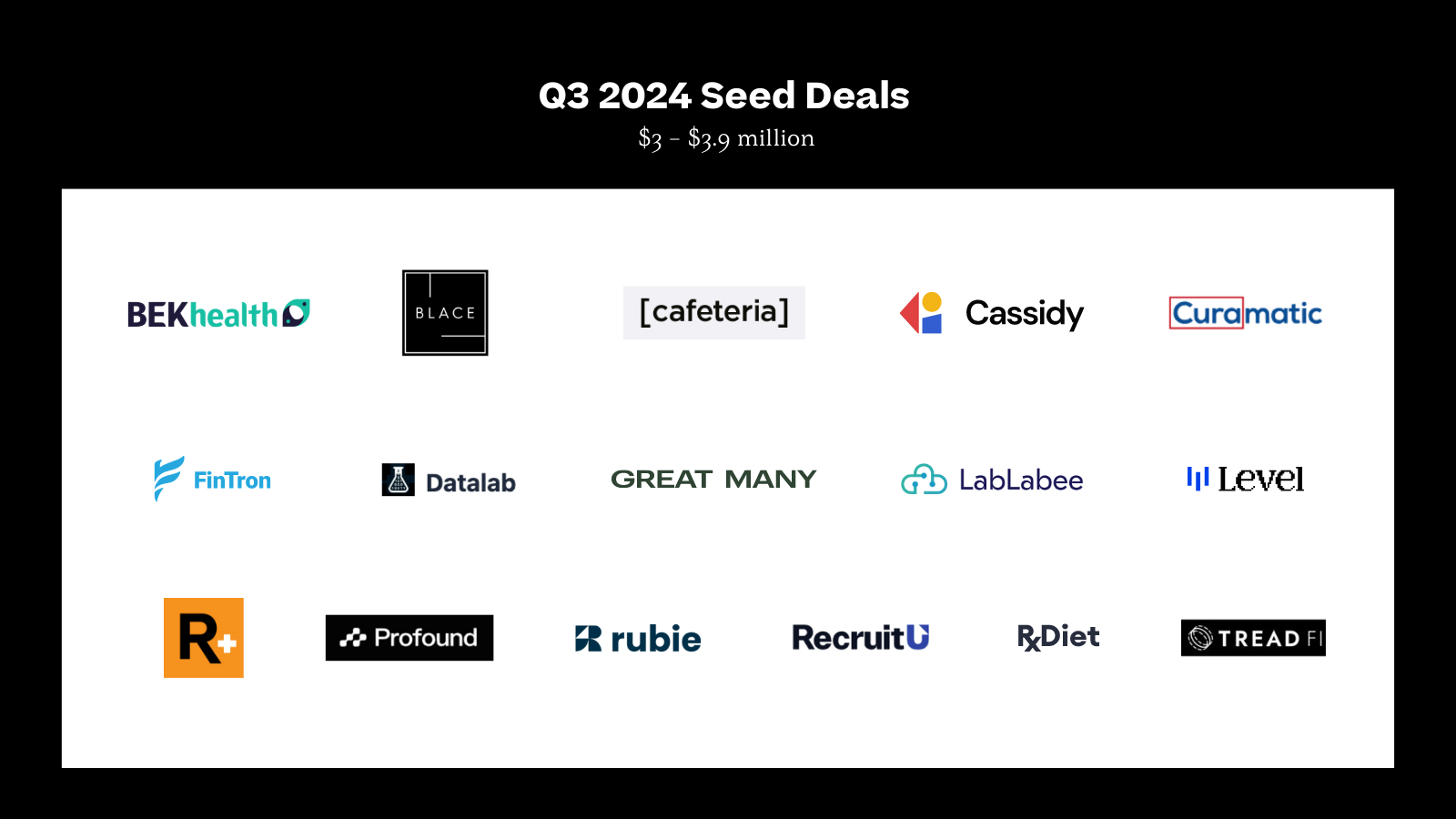

In Q3, AI-powered healthcare workforce management platforms are gaining significant traction as the industry confronts persistent staffing inefficiencies and fragmented solutions. These platforms not only address the operational complexities of managing an overextended workforce, but also focus on solving financial and human capital management struggles. M7, a new-age nurse operations platform, raised $4M from First Round to continue building out its solution which provides automatic shift scheduling, real-time operational insights, and data-driven staffing metrics. This technology enables healthcare organizations to optimize their staffing levels and also goes a step deeper in offering nurse benefits management, financial forecasting, and career development opportunities. Similarly, Arya Health secured $4M from Twelve Below to enhance its workforce automation platform, designed to streamline the management of healthcare staff and increase operational efficiency. Arya’s platform integrates all types of workforce data to equip managers with comprehensive workflows for managing shifts, payroll, and retaining employees. Both companies are tapping into the growing demand for platforms that improve staffing flexibility and efficiency in healthcare, reflecting a broader trend toward technology-driven workforce solutions.

The paradigm for how consumers search the web and brands get discovered is shifting dramatically thanks to AI. With tools like Perplexity and ChatGPT replacing a typical Google search, or Google’s Gemini-powered AI search consolidating typically SEO-ranked results, brands must respond effectively to ensure their products are capturing the eyes of their buyers. Profound, with a $3.5M seed led by Khosla Ventures, Saga Ventures, and South Park Commons, is helping monitor sentiment and performance around brand mentions in generative AI searches on platforms like Perplexity, improving their AI SEO. Beyond ensuring their product remains relevant to AI search tools, brands continue to adopt new AI technology to improve their e-commerce presence as well. This quarter, Velou raised $4.53 million, led by ANIMO Ventures and Fuse, to supercharge a brand’s product catalog, through improved product discovery thanks to visual search, dynamic SEO, and product data enrichment. As brands are dependent on conversions across their digital channels, we’re interested to see the next generation of platforms that will drive sales outcomes in the era of AI.

We’ve seen an increased focus on remediation tooling in cyber, as the identification market has consolidated to a few key players like Wiz and Cyera. This quarter, there have been public funding announcements for several startups tackling different remediation attack vectors, from identity, to Kubernetes, to the cloud. Hydden raised $4.4M from Access Venture Partners to focus on identity management for the sprawling number of identities for individual employees, as well as non-human accounts, with remediation workflows that ensure a secure identity posture. Zest Security raised $5M from Hanaco Ventures, Silvertech Ventures, and World Trade Ventures to implement dynamic cloud remediation strategies, aiming to reduce time to repair risky infrastructure and eliminate manual triage. For a fleet of Kubernetes clusters, detecting and managing dependencies around upgrades can be a time-consuming security risk for dev ops teams. That’s why we previously backed Plural, which is ensuring dependency management with their secure platform for k8s infrastructure.

We’re eager to see the growing number of NYC cyber companies bringing AI-powered remediation solutions to market.

AI is going to revolutionize multiple elements of the Built World, from architectural design to permitting applications and construction takeoffs. This quarter, early stage investors have been particularly bullish on predictive models enriching existing datasets to unlock better decision-making across stakeholders in commercial and residential real estate. Epum, which raised a $1.6m round led by Curiosity VC, is leveraging data and AI predictive models to help commercial real estate developers source and close high-quality deals. In addition to providing custom data sets, Epum trains AI models to forecast outcomes like population growth or urban growth that will impact the value of an investment long term. On a similar theme, Minerva raised $7.51m from Soma Capital, KBW Ventures, and others to empower real estate agents with better data on leads, including the likelihood to transact and size of the transaction. Both companies are aiming to structure and improve messy and unstructured real estate data. We’re particularly excited to see if these companies will ultimately use AI and/or humans in the loop to create new proprietary datasets that deliver 10x value for their customers.

There are clear AI applications in the legal services industry. LLMs help index search and reasoning capabilities among large volumes of data. Web-enabled workflows create a better UX for professionals operating with legacy tech stacks that are not compatible with new technologies. Ultimately, these tools must produce results that balance speed, thoroughness, and accuracy. As we’ve spent more time with companies in the space, we believe that the winners will take on a verticalized approach that leads to a contextual understanding beyond traditional keyword-based methods. Garden, an AI-powered platform for patent intelligence that embeds patent claims, disclosures, and relational information, raised a $6.8m seed from Spark Capital. A different way to tackle the verticalized approach is based on user type as seen with Anytime AI, an AI legal assistant for plaintiff lawyers, who raised a $4m seed from Gopher Asset Management and Kao Family Office. We’re excited to see how the verticalized thesis plays out, and how legal tech transforms from a purely services-driven offering to a product-driven offering with incremental intelligence tools.