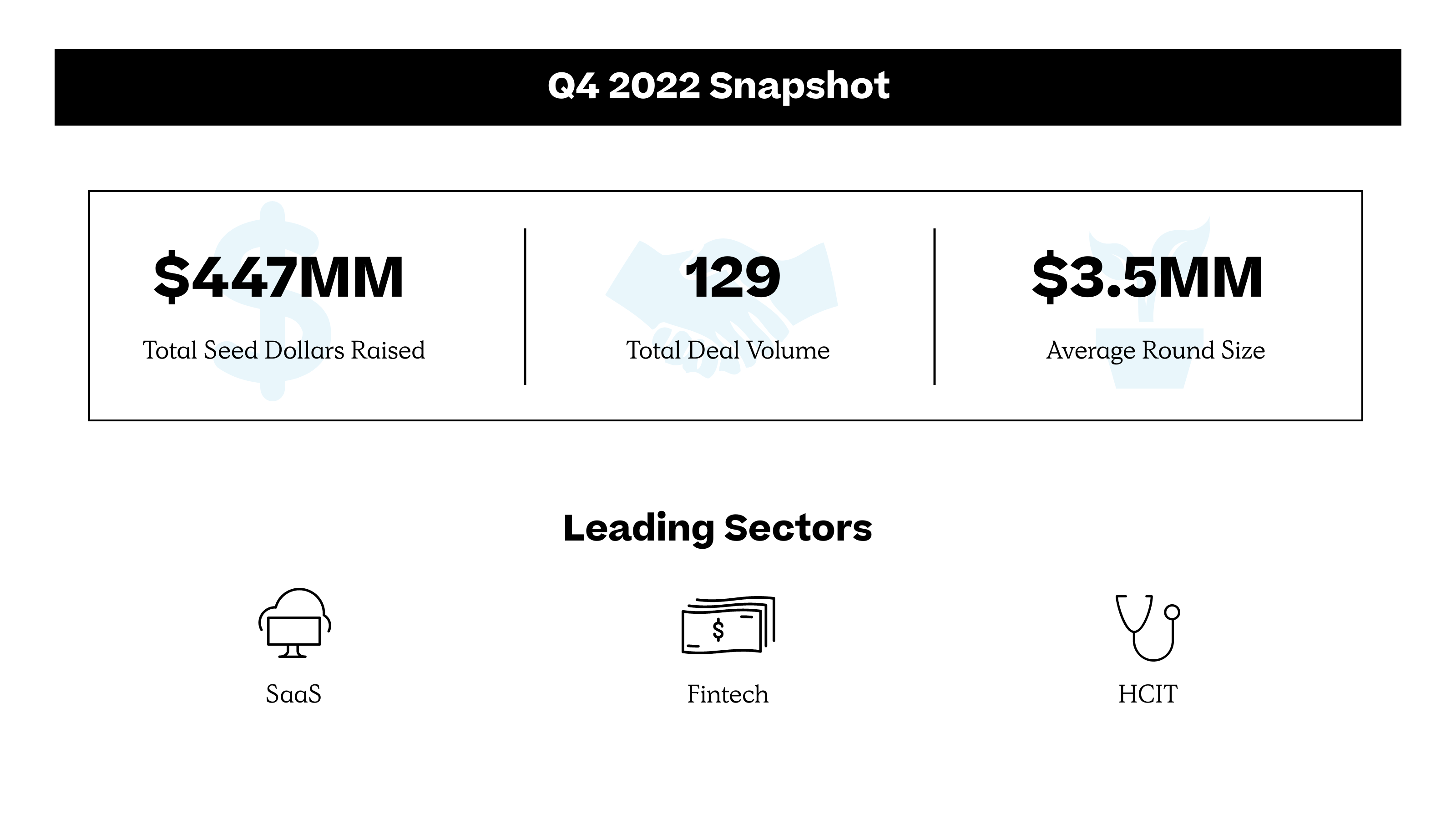

The NYC Seed Report: Down Bad in Q4

With total dollars down 48% from the preceding quarter, the seed environment is starting to see a long-anticipated tumble. These are the brave founders up to the challenge.

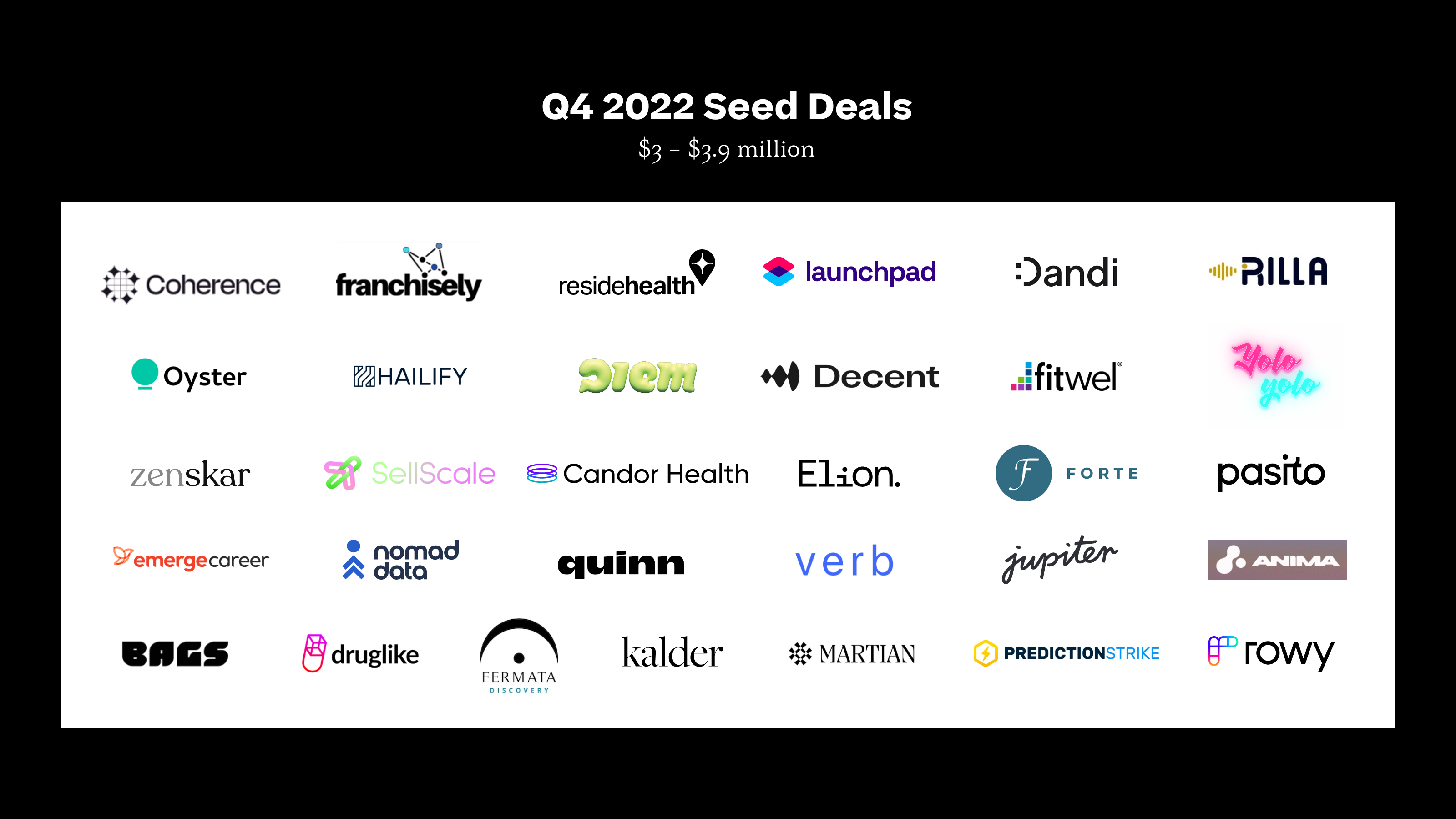

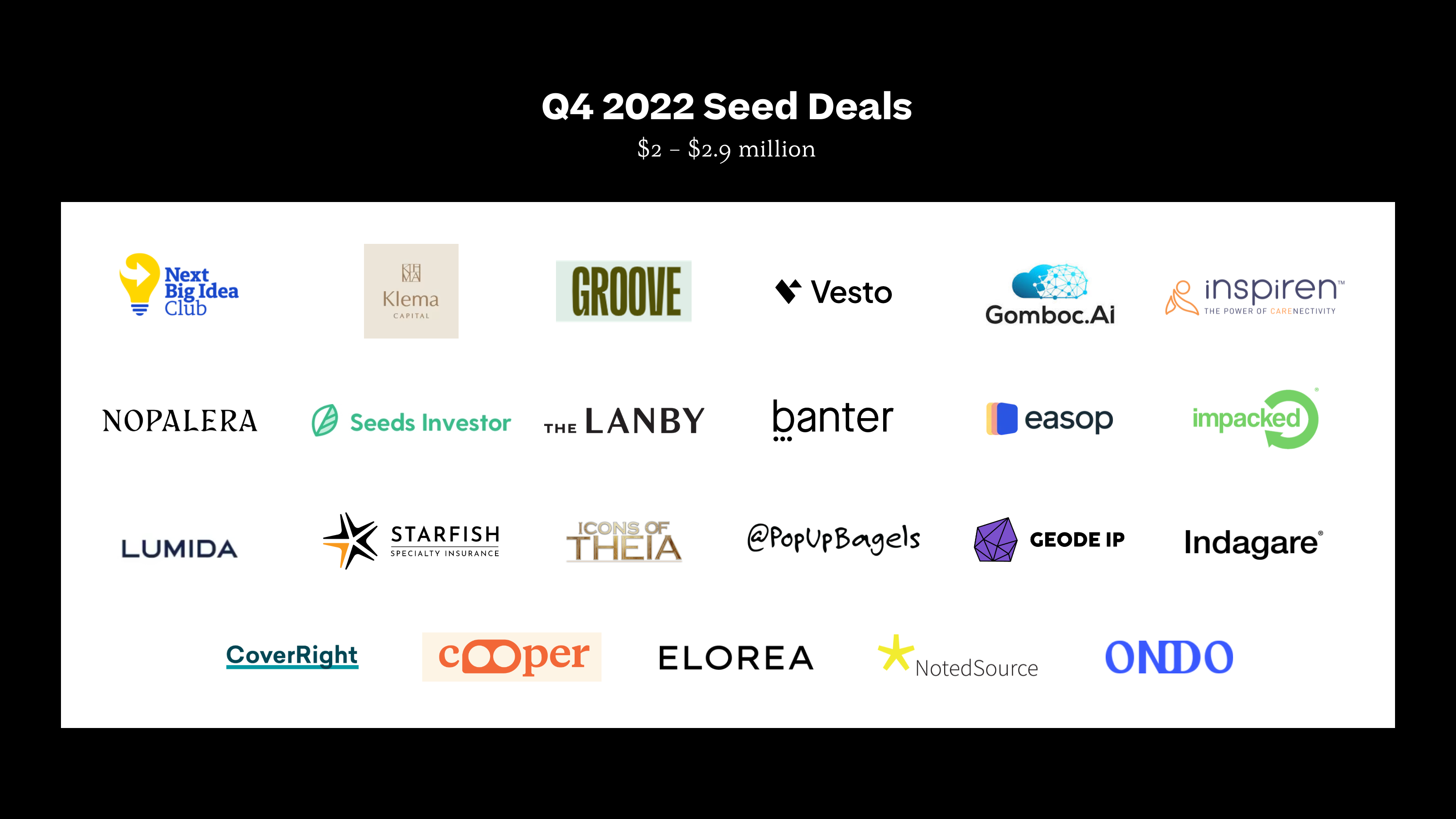

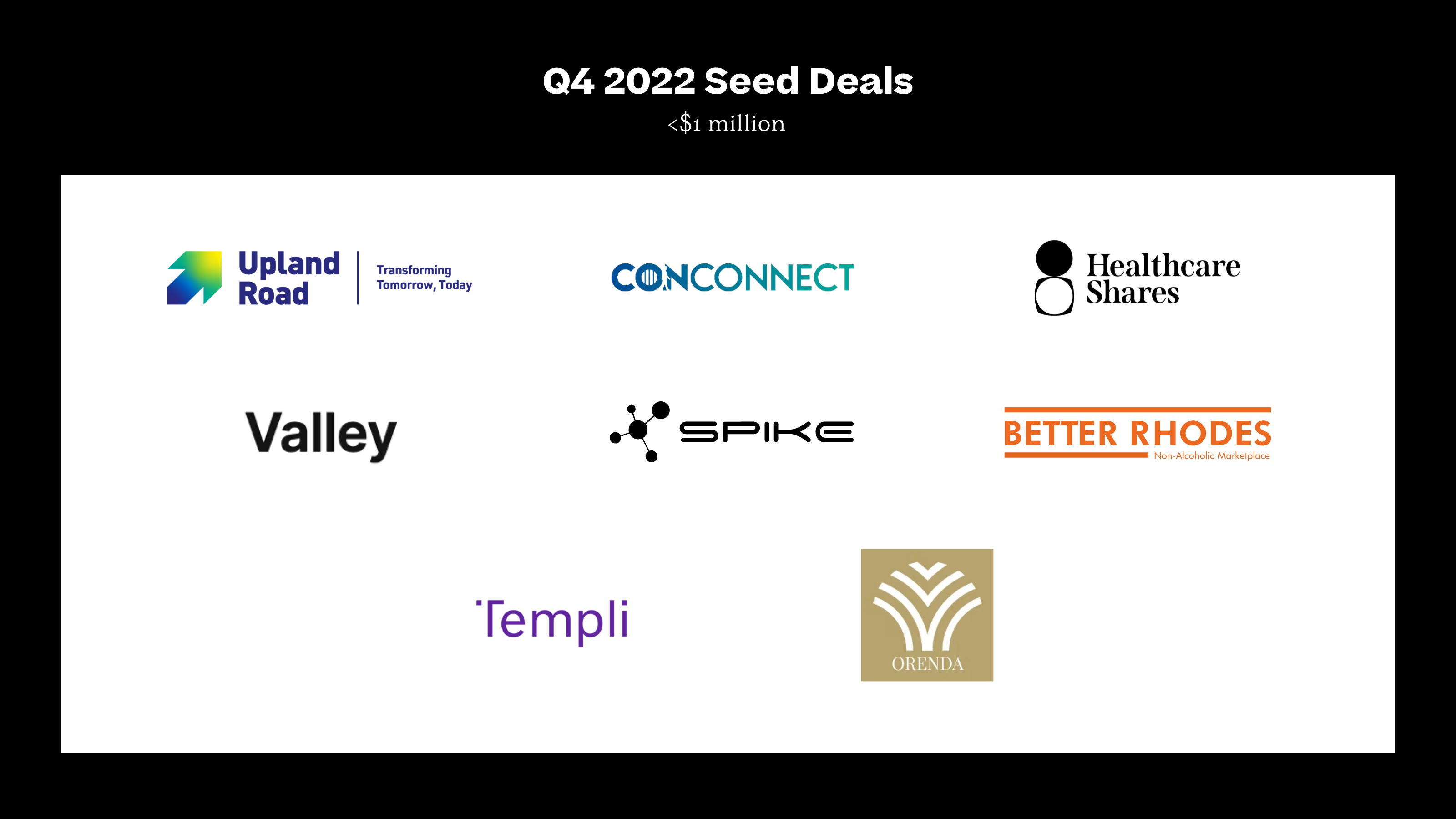

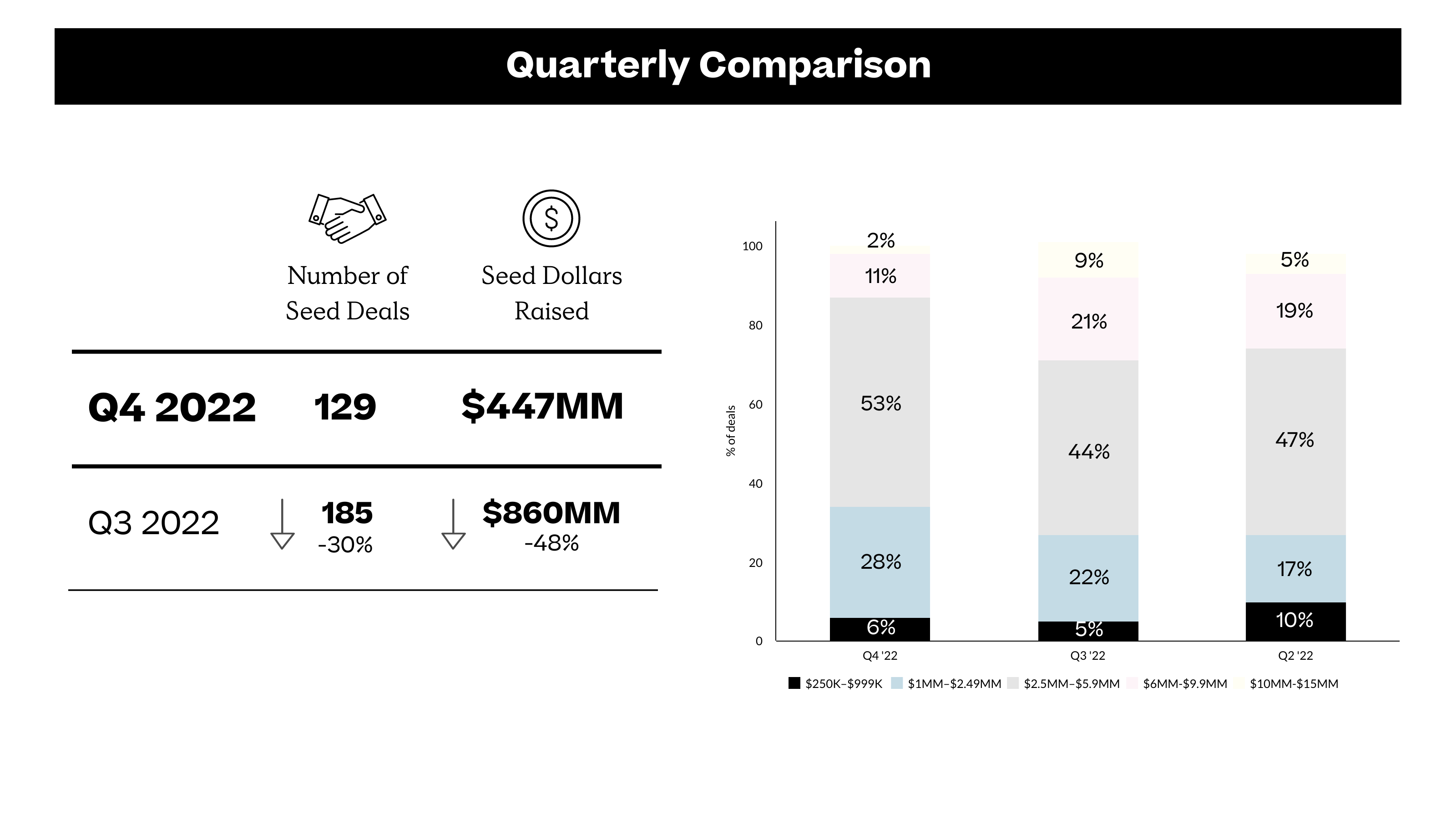

Our long-predicted wipeout of New York City seed deals has finally hit. We classified Q3’s 8% decrease in deal count and <1% decrease in total dollars raised as a “quiver,” but in Q4 deal count was down 30% and total funding down 48%.

Tech may be suffering a shock of record-breaking layoffs, but the overall economy is maintaining record-low unemployment and ongoing inflation. Which means the worst is yet to come, as Primary’s cofounding General Partner Brad Svrluga wrote recently. Tech’s bursting bubble will soon hit the wider economy, reverberating back as an even harder hit to startups. The founders who run into this environment with blind optimism will do so at their own peril, but as told by many a downturn, these challenging times will forge some tough teams that go on to dominate new markets.

Here are trends the team is seeing as we review who raised in Q4 of 2022:

Driven by high interest rates and low inventory, the U.S. housing market has certainly cooled down over the past three quarters. With that said, seed investing is a long game and several NYC fintechs are poised to capitalize on the inevitable resurgence of the housing market. Currently, the mortgage tech stack is largely dominated by legacy loan origination systems with challenging interfaces and limited integration capabilities. Lenders struggle to efficiently source, underwrite, and disburse loans due to platforms’ clunky single-player interfaces. The mortgage lender of tomorrow wants low cycle times and more targeted lead generation, leaving plenty of room for data-driven software solutions. Pylon Lending, who recently raised a $8.5 million round led by Conversion Capital, is tackling the core operating system of the mortgage market through its mortgage-as-a-service solution that gives lenders the ability to fully customize their mortgage infrastructure. Taking a more systems thinking approach to the mortgage industry, Plus Platform is addressing the challenges in residential mortgage portfolio management through its platform that gives investors access to key data throughout the lifecycle of a loan. Plus Platform raised a $1.5 million round led by TTV Capital. We’re excited to see continued innovation in the mortgage tech stack and would love to chat if you’re building in the space!

As the past few years have seen an explosion of digital health platforms, have we now created an environment where we need to build yet more platforms to connect them all?! More on that in later posts, but focusing our lens on Q4 2022, we saw companies funded that focus on combining data from disparate digital platforms to augment workflow and the patient experience in some of healthcare’s largest arenas. Our first example is Candor health, which aims to serve as an ‘intelligence layer’ playing matchmaker for patients in need of high quality post-acute facility care, powered by underlying insurance, provider, and clinical data, recently raised $3.38 million. Adonis, a provider payments tech platform that integrates various platforms (e.g. EHR, practice management, billing) and applies ML to improve revenue collection, raised $5.6 million from Asymmetric Capital Partners, Bling Capital, Correlation Ventures, Homebrew, and Max Ventures, among others. Lastly Ambit, which provides digital, diagnostic, and analytics products and services to biopharma companies developing life-altering therapies for patients with rare and specialty diseases, helping locate, engage, and analyze patient needs to advance rare and specialty pharma needs, raised $1.5 million.

For years, investors have spoken about how traditional BI tools are lackluster. Different stakeholders in an organization want to be able to access the right data, at the right time, and with a simple press of a button. Traditional tooling has made data too challenging to access, and oftentimes even knowing where to look and how to query information requires the assistance of someone more technical, like a data scientist, at the expense of speed and efficiency. Many companies are biting off parts of this data accessibility problem in different markets and for different use cases. Redbird raised $7.6 million from B Capital and others to enable analytics for business users, primarily at ecommerce and consumer businesses. Seek AI raised $7.5 million from Conviction Partners and Battery Ventures to build a generative AI data querying tool for non-technical users. Finally, Mergestat raised a $1.2 million pre-seed from Caffeinated Capital and OSS Capital to build a SQL querying tool for engineering teams to access operational analytics data.

The proliferation of products like Snowflake has made data infinitely more accessible to data science and engineering teams. Commercial and operations teams have not been able to unlock as much value from data, mostly due to the technical skills required to use these tools. In Q4, we saw companies building both horizontal and vertical solutions raise seed rounds to address that skill gap head-on. The solution sets addressed data accessibility pain points for users anywhere from sales and marketing to supply chain management and accounting. One example was Redbird raising $7.6 million from B Capital Group to build a point-and-click interface that allows non-technical users to query databases and build data analytics workflows without writing a line of code. Nomad Data also launched a data relationship management platform that helps non-technical employees see where all data in their organization comes and how it changes without engaging directly with a database. They closed $3.2 million of seed funding led by Struck Capital. Other verticalized solutions have hit the market like Fermata Discovery, which raised $3 million from New North Ventures and strings together public and private case data needed by law enforcement, legal practices, journalists, and other investigative organizations. There’s no question that executives recognize the value of data to their organizations, but hiring more data scientists in an extremely cost-conscious macro environment will be a tough pill to swallow. Tools that make it easier to turn non-technical teams into data scientists may be the path to scalably unlocking that value.