Why You Need To Treat Lifetime Value Like a Team Sport

Regardless of what you think of the metric, it offers a powerful example for how teams can rally together to achieve company-wide growth goals.

With the Summer Olympics upon us, what better time to talk about team sports in the context of SaaS metrics? I’ve long emphasized the importance of executives embracing a “First Team” mentality and relatedly, avoiding what I’ve dubbed the “swim lane trap;” in my experience, the implied ownership of the lifetime value metric (“LTV”) is one of the most frequent and flagrant violations of both concepts.

Before we delve deeper into why lifetime value optimization is the ultimate team sport, I’ll admit this: lifetime value is not my favorite SaaS metric. For early stage companies, it is actually a pretty useless concept, as the underlying inputs and assumptions for the metric (e.g. churn) are still pretty raw estimates. And in later-stage businesses, LTV still isn’t a leaderboard metric, as it isn’t updated or recalculated that frequently. Putting those limitations aside, however, the concept of lifetime value is deeply important to any company, as higher LTV figures unlock greater leverage on the customer acquisition front: the higher your LTV, the more you can spend to acquire a new customer. What matters to every business—regardless of stage—are the inputs that drive the calculation, and those are the shared responsibility of every function in the business.

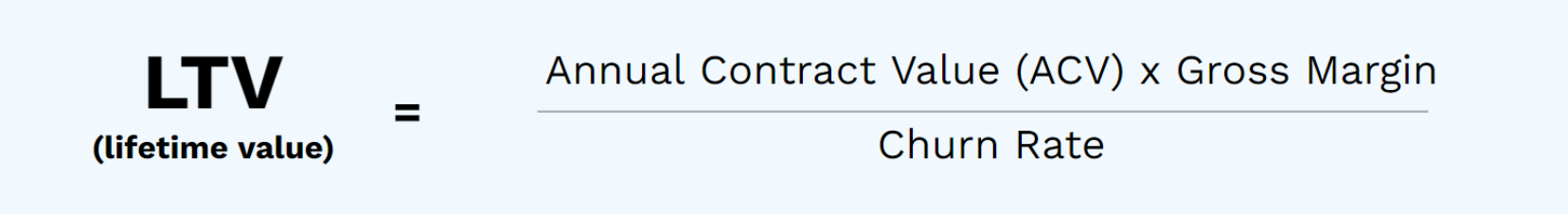

Breaking down the formula

While the LTV formula is a relatively simple one, I am constantly amazed by how few leaders really have a command for how it works. As you’ll note below, there are three core inputs that drive LTV: average annual contract value (ACV), gross margin, and churn.

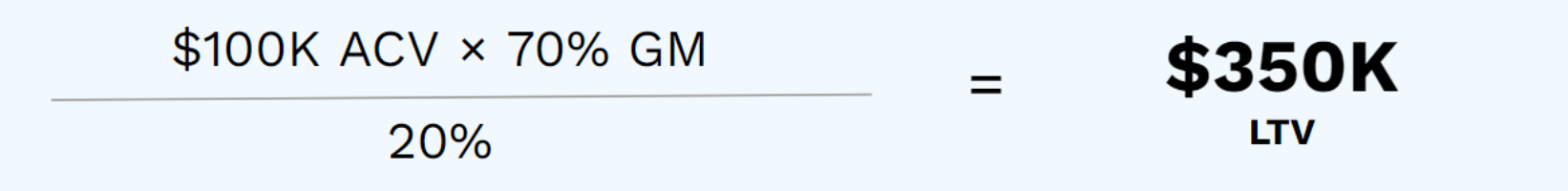

In a hypothetical scenario in which Company X has $100K average ACVs, 70% gross margin, and 20% logo churn, their LTV works out to $350,000 (see below). In a world where we aspire to have a 3:1 ratio of LTV/CAC (customer acquisition cost), Company X determines that they can spend ~$117,000 to acquire a new logo.

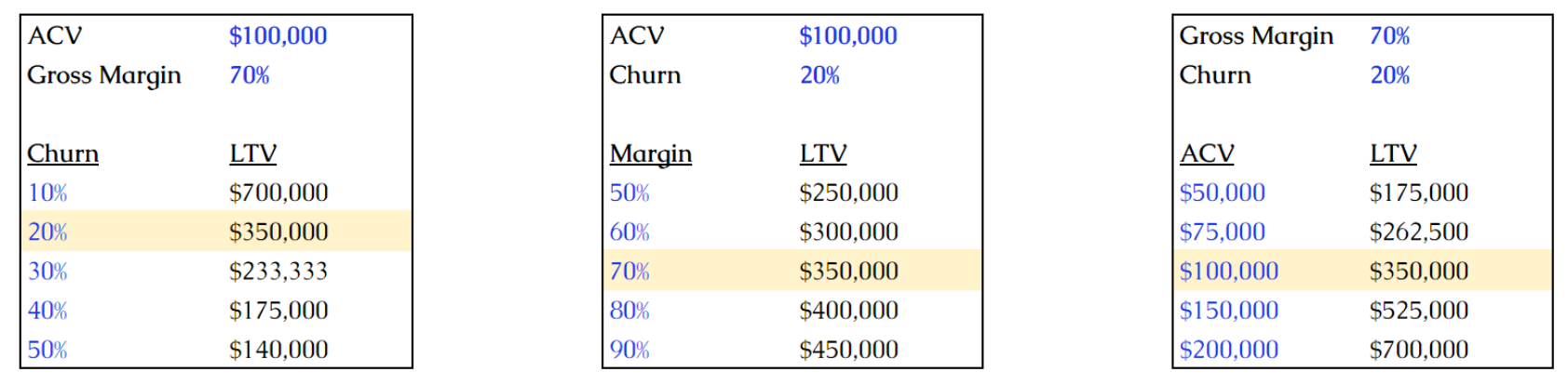

It is important to note that a change in any one of the three input metrics (ACV, gross margin, churn) has the ability to pretty drastically change LTV. In the scenario analysis below, I’ve highlighted the aforementioned “base case” for Company X, and then modeled out three scenarios in which just one of the three input metrics changes, and the resulting change in LTV.

A few example highlights from the scenario analysis:

- If ACV and gross margin remain constant but we reduce churn from 20% to 10%,LTV doubles to $700,000.

- If ACV and churn remain constant but we let our gross margin degrade from 70% to 60%,LTV decreases by 14%to $300,000.

- If gross margin and churn hold steady but we let our average ACV fall to $50,000 to accommodate smaller customers, our LTV is cut in half to $175,000.

LTV Scenario Analysis

Lifetime value is frequently talked about in the realm of customer success, but as these examples demonstrate, maximizing the metric requires much more than just good old-fashioned churn prevention.Every function in a SaaS organization ladders up to at least one component part of the LTV metric.

Maximizing annual contract value

The March installment of Tactic Talk offered a number of methods for growing the ACV of the installed base of customers, but boosting ACV is of course relevant forbothnew and existing customers. Here are a few quick examples for how different functions can help maximize ACVs:

- Finance and Strategy(or whichever team owns pricing) should be consistently revisiting the pricing heuristic to ensure that the company is maximizing willingness to pay. If you are sitting in an organization that is capturing 10% of the value you’re creating for customers, you are leaving serious money on the table. Beyond willingness to pay, SaaS pricing owners should also be thinking creatively about product packaging and bundling. Does your team have multiple products to sell? How can you structure contracts in a way that incentivizes customers to purchase multiple products? How do you adjust your team’s incentives to do the same?

- Sales plays a very important role in ACV optimization; they should aspire to sell as much as possible—and that is still logical for the customer—in the upfront contract. (And I’ll once again quote the old Charlie Munger line: “show me the incentive, I’ll show you the outcome.”Be sure your variable compensation plans are well-aligned to your business targets)

- Customer success certainly isn’t off the hook! It is important that the CS organization has a solid rhythm for expanding accounts at renewal and driving ongoing cross-sell throughout the customer lifecycle. Again,we reviewed some specific tactics for doing so a few months back.

Boosting gross margin

Gross margin is my favorite input into the LTV equation on account of how many levers there are to grow it. I shared a number of low-hanging fruit opportunities for gross margin optimization in the April edition ofTactic Talk; here are a few examples of how different business functions can play their part:

- Management elects to open an expansion office in a non-Tier 1 city to reduce salary expenses.

- Support launches a knowledge base with in-depth how-to articles and videos in an attempt to deflect support tickets (thereby requiring less agent coverage).

- Products aligns closely to the Support organization to unpack which ticket types are most costly to the organization, and ships enhancements that help to deflect support tickets altogether (i.e. not even a need for the knowledge base!).

- Every leader with staff in the COGS/cost of revenue line takes a relentless approach to ensuring team members are focused on their highest-value work activities. If you have CSMs digging in on technical support work, that is a borderline financial crime: support agents typically earn 25%+ less than CSMs, so that work should be reallocated.

Reducing churn

The most straightforward way to understand the power of the churn input in the LTV equation is to think about what it means for the impliedlifetime. If Company X has 33% logo churn, the implied customer lifetime is 1 ÷ 33% churn rate, or three years. If the company’s churn increases to 50%, the implied “lifetime” is now 1 ÷ 50%, or just two years.(Editor’s note: if your churn is 50%, you have bigger fish to fry than reading this post!)

The customer success organization is certainly the captain and quarterback of the churn mitigation operation; the CS team extends implied lifetime through tried and true retention tactics such as regular business reviews, product adoption audits, executive sponsorship and so forth. But churn mitigation extends well beyond customer success:

- Product plays an important role by launching features that resonate with customers and command adoption and frequent usage. The best customer success team in the world can’t plug the leaky bucket if the product roadmap is not well-aligned to customer needs.

- Engineering must ensure that the product/platform is stable and reliable for customers.

- Sales helps to extend assumed lifetime by staying focused on the right ideal customer profile. It is baffling to me how many companies willingly sign on customers that fall into historically high-churn segments without deep scrutiny/advocating for why the exception should be made.

Here are 10 internal and customer-facing processes to consider implementing as you cement customer retention as everyone’s job.

I regularly preached the gospel of “retention is everyone’s job” while I was a CRO. For Halloween 2019, a number of my direct reports dressed up as me for Halloween and carried signs with some of my “-isms” – check out the one that is front and center! Senior leaders, it is on YOU to set this tone for your teams.

—

I said at the onset that LTV is an imperfect metric; this is particularly true for early stage companies given that CAC is most often analyzed in the context of a payback period versus against lifetime value. Next month I’ll offer a deeper dive into CAC paybacks and allowables to round out that thinking, but here’s the truth: even for early stage businesses, the LTV inputs very much matter: every company should be thinking about ACVs and margin profiles from the onset, and customer health/utilization can act as a powerful proxy for churn before formal churn data is available.